Oil prices tested the $50-per-barrel mark on Thursday as production outages brought a faster-than-expected recovery to an oversupplied market.

Global benchmark Brent crude oil was down 35 cents at $49.40, having earlier risen as high as $50.51 in intraday trading.

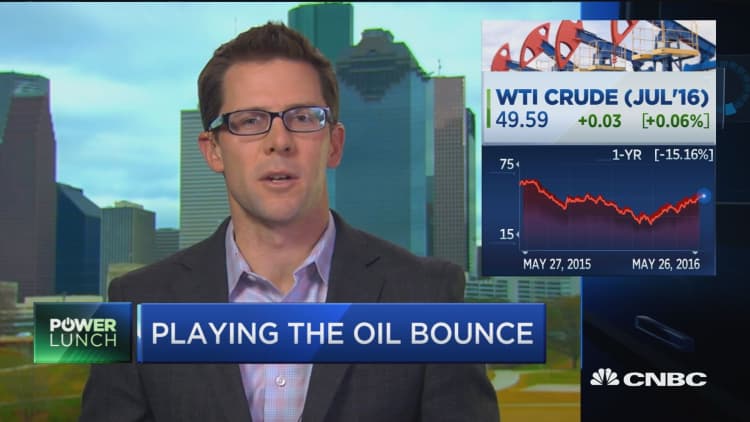

U.S. crude futures settled down 0.16 percent, or 8 cents, at $49.48 a barrel, and were last down 22 cents at $49.34 a barrel, after rising to $50.21, the highest since mid-October.

The daily settle came as presumptive Republican presidential nominee Donald Trump criticized environmental regulations on oil and coal.

While a crude glut could grow in coming months if demand stalls, wildfires in Canada's oil sands, unrest in the Nigerian and Libyan energy sectors, and a near economic meltdown in OPEC member Venezuela have knocked out nearly 4 million barrels per day in immediate production.

That has enabled futures of Brent and U.S. crude's West Texas Intermediate (WTI) to gain nearly 90 percent from the 12-year lows seen this winter, and recoup about half of what they lost since mid-2014 when both traded at above $100 a barrel.

But some market watchers say oil's climb to above $50 for the first time in seven months could spur producers, particularly U.S. shale drillers, to revive scrapped operations that could again bloat supplies and trigger a selloff.

"I am maintaining my oil view at neutral with a short-term bias to the upside," said Dominick Chirichella, senior partner at the Energy Management Institute in New York. "The global surplus still exists and there is still a possibility that oil prices could retrace further."

But he conceded that crude was trading "more and more in sync with the forward looking or perception view, with the overall bearish fundamentals mostly priced into the market as production issues offset any short term negativity."

Adding to outage concerns, a source at Chevron said the producer's activities in Nigeria had been "grounded" by a militant attack, worsening a situation that had already restricted hundreds of thousands of barrels from reaching the market.

Investors will be watching next month's meeting of the Organization of the Petroleum Exporting Countries (OPEC) for signs of a output hike now that oil had reached $50.

OPEC officials gathered in Vienna ahead of the June 2 meeting of the group's oil ministers have said any official change to its output policy was unlikely.

A larger-than-expected draw in U.S. crude oil inventories last week indicated buyers are starting to mop up spare supply.

Still, a fight for market share between key members Saudi Arabia and Iran is causing a concern for investors.

"The bigger risk is that following the meeting, (the) Saudis will increase production to meet rising summer domestic demand, to preserve market share in its oil wars with Iran and Iraq," David Hufton, head of PVM Oil brokers, said.

— CNBC's Tom DiChristopher and Jacob Pramuk contributed to this report.