Crude prices will continue to rise this year and that means some oil companies will probably start spending money again, two industry chief executives said Tuesday.

Superior Energy CEO David Dunlap anticipates prices will hit $60 per barrel by the end of the year.

"In the second half we're going to continue to see prices migrate up as the market begins to realize that non-OPEC production is coming down, including shale production here in the U.S., and we're going to be getting closer and closer to that supply-demand balance," he said in an interview with CNBC's "Power Lunch."

Oil closed higher Tuesday on expectations about the crude stockpile and continued worries over potential supply shortages from attacks on Nigeria's oil industry.

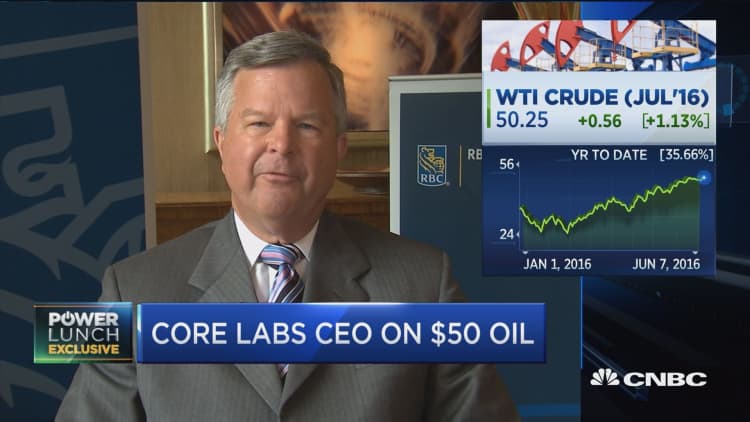

U.S. crude settled up 1.4 percent, or 67 cents, at $50.36 a barrel, its first close above $50 since July. was last up 97 cents at $51.52 a barrel.

Core Laboratories CEO David Demshur agrees there should be more balance in the crude market by the end of the year, with a net decline of approximately 2.75 million barrels expected this year and an increased demand of about 1.2 million.

With oil prices rising, that means spending will tick back up, especially by the big oil companies that have been slashing their capital expenditures, he told "Power Lunch."

"I think their capex budget cuts are over and we're going to see them start to spend money and develop their reserves around the world," he said.

However, many exploration and production companies in the U.S. are now cash-strapped, said Dunlap. Therefore, only some will start to spend incremental dollars when oil is set into a range of $50 or better.

"It's going to be difficult for many companies to be responsive as commodity prices get better," said Dunlap.

That said, since some have indicated there will be more activity in the second half of the year, he thinks rig counts have "probably" bottomed.

— Reuters contributed to this report.