Amid global oversupply and a strong U.S. dollar, crude's downward spiral will continue, according to one of Wall Street's largest firms. But that may not be terrible news for all investors.

"Oil could get down to the $35 per barrel level, which would most certainly at this point take the equity markets with it," Bank of America Merrill Lynch's Paul Ciana told CNBC's "Futures Now" on Tuesday.

In January, crude and equities traded in a near identical correlation before the February lows. Ciana explained that with crude now down 21 percent from the year-to-date highs, he's concerned that eventually equities may feel the impact. Then, global markets could see another spike in volatility as investors grow worry about a correction.

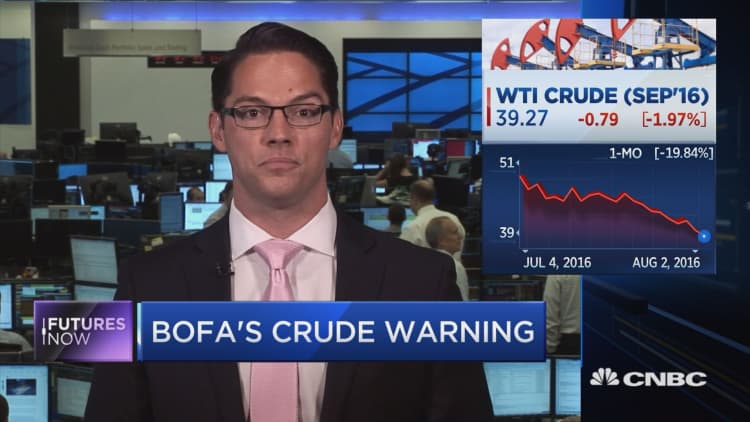

Crude fell more than 1 percent on Tuesday to settle at its lowest level since April. On Wednesday, U.S. crude was up slightly but still below $40 a barrel.

"We could see the beta between crude and global markets increase again," Ciana said, referring to volatility. "Oil has reached the target from the technical top, and seasonals point to weakness in September to October."

Seasonal patterns may be the biggest headwind for crude, since prices typically peak in August toward the end of the summer U.S. driving season and then decline on average through November. With crude at the lows in August, Ciana sees trouble.

"Crude oil is already down so much from the June [$51 per barrel] highs," he said. Ultimately, Ciana said, this week's break below $40 could lead to a retracement of the year-to-date high-low range of $35.84. However, this movement could also provide a fresh opportunity for commodity investors in the mid-term.

"The next trade for crude oil would be to let it get down to the mid-30s and let some of that risk offset sentiment," Ciana said. "Let some of the headlines run and then take a stab at actually buying crude oil."

Ciana concluded that, at an intermediary trend perspective, if crude can hold the $35 support level the technical set-up would be in place to begin forming the right shoulder of a head-and-shoulders bottom pattern.

"From that point, we would need to see crude rally up to test the neckline and break through $52. That could launch crude oil much higher into 2017," Ciana said.