European stocks finished on a positive note on Tuesday after several major earnings that beat expectations.

The pan-European STOXX 600 ended up 0.92 percent provisionally, with almost all sectors posting gains by the close.

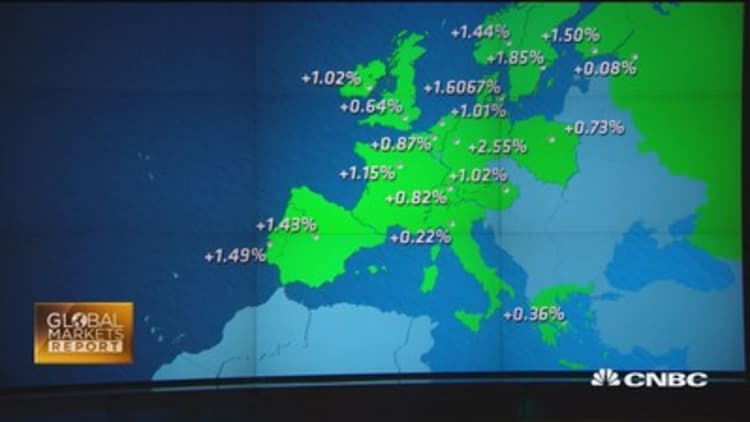

The U.K.'s FTSE 100 popped 0.62 percent and France's CAC 40 jumped 1.19 percent. Germany's DAX leaped 2.5 percent, helped by a strong performance in German automakers.

European markets

Amec Foster, Altice top the STOXX 600

On the earnings front, Amec Foster Wheeler reported a £446 million ($579.4 million) pre-tax loss in the first half of 2016 compared with a £73 million profit in the same time last year. However, shares ended near the top of the STOXX 600, up 11.7 percent.

Netherlands-based telecoms firm Altice was the STOXX 600's best performer, soaring close to 15 percent after it reported a rise in second-quarter core earnings and confirmed its 2016 guidance.

The U.K.'s Worldpay also jumped 3.2 percent after it reported expectation-beating core earnings for the first half of the year. Worldpay floated on the London Stock Exchange in 2015.

Danish jewelry firm Pandora sunk as much as 5 percent after its second-quarter net profit missed analyst expectations. The stock pared losses later in the day, to close over 4 percent down.

Legal and General sank 5.5 percent, despite reporting a nearly 10 percent rise in first-half operating profit.

Standard Life shares were given a sharp boost after the British insurer and asset manager said its first-half assets under administration rose 7 percent, while it also increased its dividend. Shares jumped over 6.5 percent.

Overall, the second-quarter earnings season has been reassuring for Europe so far. Out of the 77 percent of firms in the STOXX 600 index that have reported, 61 percent have either been in line with or beaten expectations, according to Reuters, citing StarMine data.

In other corporate news, Dutch recruitment firm Randstad announced plans to buy U.S. rival Monster for $429 million. Randstad shares reversed earlier losses to finish higher.

Online grocery delivery firm Ocado jumped some 6.8 percent after signing a deal with British supermarket WM Morrison, which will allow it to expand home delivery across the U.K. WM Morrison also closed sharply higher.

Sterling dips after BoE comments

European markets have been moving higher since the Brexit vote in late June caused turmoil in financial markets.

Last week, the Bank of England cut interest rates for the first time in over seven years, from 0.5 percent to 0.25 percent.

On Tuesday, sterling showed signs of weakness after Ian McCafferty, an external member of the BoE's Monetary Policy Committee, wrote in The Times that the central bank could cut rates further and boost bond purchases if the economic downturn in the U.K. deepened. At Europe's market close, sterling was down 0.3 percent against the U.S. dollar, at $1.2997.

At the same time, markets have been eyeing the fluctuations in the oil price, as concerns over a supply glut battled against hopes of producer action to prop up prices. Both Brent and U.S. crude fluctuated between gains and losses during Tuesday's trade, wavering around the flat line at Europe's close, trading at $45.32 and $43.11 respectively.

The fluctuation in oil kept U.S. investors on their toes during its morning session, with markets trading higher stateside around Europe's close; while in Asia, major markets advanced on Tuesday, withcooling Chinese inflation data likely spurring stimulus hopes.