European stocks closed under slight pressure on Friday as a sharp decline in mining stocks offset optimism surrounding the sharp uptick in oil prices.

The pan-European STOXX 600 ended down 0.16 percent provisionally, with sectors pointing in different directions. On the week, however, the STOXX 600 was up 1.38 percent.

London's FTSE 100 was broadly flat, up 0.02 percent, while France's CAC 40 fell 0.08 percent and Germany's DAX slipped 0.27 percent. A handful of peripheral indexes ended trade in the black, however many closed flat to lower.

Miners keep a cap on markets

European markets

On the last trading day of the week, a whole host of topics were on the table, from economic data to commodities and earnings reports.

European markets were initially boosted by a strong market performance in Asia where markets finished mostly higher on the back of record finishes in the U.S., while traders shrugged off the torrent of economic data from China that missed expectations.

In China, industrial output for July grew 6 percent on-year, a touch lower than what analysts had expected. Retail sales were up 10.2 percent in July versus a forecast of 10.5 percent, while fixed asset investment growth eased to 8.1 percent on-year in the January-July period, however the market was expecting a number of 8.8 percent, according to Reuters.

Europe was also digesting its own set of data, with Germany's economy expanding 0.4 percent in the second quarter of 2016, which was above expectations, but below the previous quarter's figure of 0.7 percent. In the U.S,, markets traded slightly lower following a disappointing set of retail sales data, which came in unchanged, despite economists expecting a 0.4 percent increase.

Meanwhile, oil prices continued to have an influence on international trade. Following a strong set of gains on Thursday, crude futures fluctuated on the week's final day of trading, as a supply overhang continued to weigh on investors, yet weakness in the U.S. dollar helped prop up prices in the afternoon session.

Both Brent and U.S. WTI fluctuated between gains and losses during the session, trading higher at Europe's close, around $46.78 and $44.42 respectively. In stocks, Tullow Oil led the sector, closing up 4.16 percent after Bank of America Merrill Lynch raised its rating from "neutral" to "buy".

Miners however were some of Europe's worst performers on Friday, as metal prices showed signs of weakness. Anglo American, Antofagasta and Rio Tinto were all sitting near the bottom of Europe's benchmarks during the session, closing down over 3 percent each.

PageGroup, Maersk rise

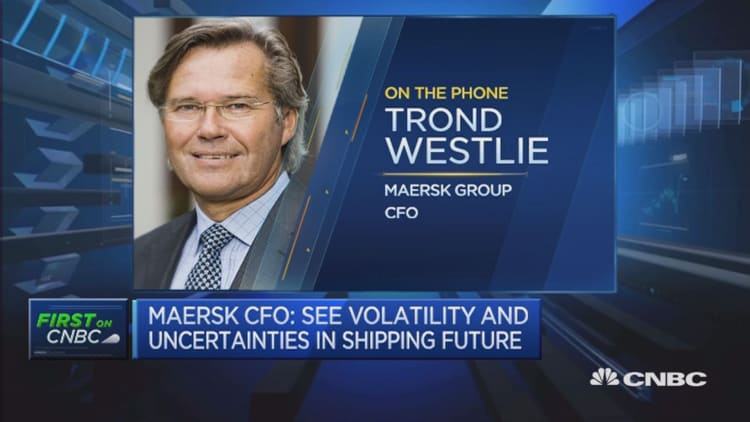

In individual stock news, Moller-Maersk was one of the STOXX 600's best performers, with second-quarter net profits coming in at $101 million, falling short of analyst expectations as it grapples with the slump in oil. The shipping giant also chose to keep its full-year profit outlook unchanged. Shares came off their highs to close above 3 percent.

Europe's top performer however was PageGroup, after both Barclays and Numis raised their price target on the stock. This comes after the recruitment firm reported a 12 percent increase in first-half operating profit. Shares jumped 5.2 percent.

German online retailer Zalando jumped over 2 percent after Exane BNP Paribas and JP Morgan raised their price target for the stock.

Broker ratings also moved other stocks, with potash miner K+S, which reported earnings on Thursday, ended in the red after a number of banks including Commerzbank cut their price target for the stock. And British security firm G4S also closed over 2 percent down after Exane BNP Paribas cut its outlook on the stock.

Volkswagen shares closed just shy of 2 percent down, after the embattled automaker revealed that sales in Germany for July were down 8.7 percent, while the U.S. saw sales fall 5.1 percent. China sales however were sharply higher.