The risk for markets Wednesday is that the sounds a little more hawkish when it releases minutes from its July meeting.

After big swings in the currency market, traders see the potential for more volatility if the Fed minutes show members favoring a rate hike sooner. The dollar has been soggy of late and sold off Tuesday, amid low expectations that the Fed will hike rates this year, but strategists say the market may have gone too far.

The minutes are due at 2 p.m. EDT and are likely to show a Fed that sees fewer hurdles to an interest rate hike. The Federal Open Market Committee already laid some ground work for a move this year in its post-meeting statement July 27, when it said near-term risks to the economic outlook were diminished.

The view was reinforced Tuesday by New York Fed President William Dudley, who said markets are too complacent about a rate hike, and that it's getting closer to the time when it will be appropriate to raise rates, possibly even in September. But for markets, September has a very low probability and the more likely time for a hike this year would be December, after more economic reports and the U.S. presidential election.

Since the July meeting, data has been mixed. There was a strong payroll report for July and an upward revision to the already strong June report. Retail sales, however, were flat in July, but industrial production was much stronger than expected. Yet, expectations for a Fed rate hike this year remain low, in part due to the U.S. data but also concerns that the global economy is too weak.

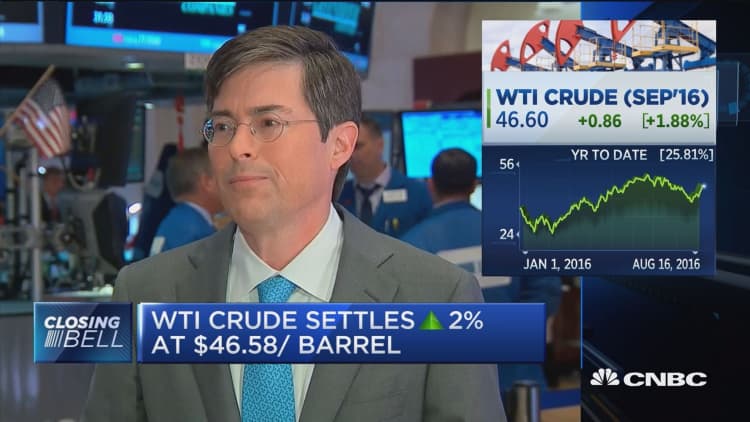

Stocks slumped Tuesday, as Treasury yields moved higher amid speculation the Fed could raise rates this year. The 10-year moved to 1.57 from 1.53 percent after Dudley spoke, and the yield was at 0.73 percent. The S&P 500 was down 11 at 2,178, and the Dow lost nearly a half percent to 18,552. West Texas Intermediate crude futures closed nearly 2 percent higher at $46.58 per barrel.

Bank of America Merrill Lynch's David Woo said the market's expectations for a rate hike are too low for September. The current environment is not bad for a Fed move, given steady financial conditions and a weaker dollar, but Woo does not expect one until December.

"They don't want to see the dollar strengthening too much. The fact that the dollar is weak is interesting. Of all the days [Dudley] picked to sound more hawkish, he picked today … when the dollar was weak," said Woo, head of global interest rates and foreign exchange strategy. Dudley is viewed as a member of the Fed core, aligned in his thinking with Fed Chair Janet Yellen.

"It does create the opportunity for the Fed to do what I think would be an opportunistic hike in September. I think the market is still underpricing the probability of an opportunistic hike," said Woo.

Dudley spoke as the dollar was sinking against a whole group of currencies, in part on comments from a dovish sounding San Francisco Fed President John Williams. In a paper, Williams suggested rates could stay low for a long time and said the Fed should raise its inflation target, but economists say Williams was taking a longer view and would not necessarily be against a near-term policy move.

"I suspect the minutes are going to read more like Dudley than Williams. I think they're going to emphasize the data dependence. They could mention the easing of financial conditions," said Woo.

The Fed after its July meeting acknowledged labor and consumer spending had improved but said inflation continued to lag its target. Consumer prices released Tuesday were unchanged in July but core CPI, stripping out food and energy, was up 0.1 percent, or 2.2 percent year over year, down slightly from June. The Fed's preferred inflation measure, the core PCE, has been at 1.6 percent.

One central bank official, Kansas City Fed President Esther George, dissented on the decision to leave rates unchanged at the July meeting.

The Fed next meets Sept. 20 and 21, but market expectations are less than one in five that it will take action at that meeting. Now, traders are awaiting more clues on policy tightening from Fed Chair Janet Yellen, who speaks Aug. 26 at the Fed's annual symposium in Jackson Hole, Wyoming.

"If the minutes are more likely to validate what Dudley said today, which means anything is possible … going into Jackson Hole, the market will have to be less complacent," Woo said. After the minutes, "you could definitely get some dollar reaction."

UBS economists said in a note Tuesday that the fact the FOMC mentioned that "near term risks diminished" in its post-meeting statement was an important change. "We view the FOMC bringing the risk statement back as a sign that the FOMC is beginning to prepare markets for a rate hike later this year," UBS economists wrote.

The dollar index was down almost 1 percent in late trading, at 94.79. It had earlier traded at 94.43, the lowest since June 24. Dollar/yen was at just about 100, after breaking the key 100 level earlier Tuesday for the first time since the Brexit vote in late June.

"We've had good data out of the U.S. and yet long-term rates can't go up," said Woo. "The market is therefore assuming the U.S. will not hike rates any time soon and the U.S. will continue to import easy policy from Europe and Japan. The market is very complacent on that point of view."

Marc Chandler, chief currency strategist at Brown Brothers Harriman, said something else may explain the rush into the yen, which has defied the Bank of Japan's easing programs. He did not think the market was as impacted from Williams since Fed funds futures did not move on his comments.

He did note that there is a large coupon payment from the U.S. Treasury every year in August, and since Japan is a large holder of U.S. debt, it may be repatriating some of those funds or moving to other higher yielding debt, rather than hedging new positions, given the cost of dollar-denominated investments. He said there is $37.5 billion in coupon payments and $54.6 billion in bond maturities.

Chandler said Dudley, who spoke in a Fox interview, was confirming that the market is underestimating the risk of a Fed hike. After the minutes are released, investors will be hanging on Yellen's speech in Jackson Hole next week. "It's only a big deal if she disagrees with Dudley. I kind of suspect he could have stolen some of her thunder," he said.

Woo said the yen move is not surprising. "We've been saying the yen is going to strengthen. I think at this point, the way I would basically see this is there's no doubt that dollar/yen goes even lower," he said, adding his forecast is for dollar/yen at 103 between now and year end. "The big story this year is going to be about the outlook for U.S. fiscal policy. Our forecast is the Fed is going to hike in December, and the chances are we'll see some fiscal easing in the next year, regardless of who wins the election. That should give the dollar some kind of boost at year end."

Ahead of the minutes Wednesday, St. Louis Fed President James Bullard speaks at 1 p.m.

Earnings are expected before the opening bell from Lowe's, Target, Analog Devices, Eaton Vance, JA Solar, Staples and Tencent. Cisco, L Brands, NetApp, Agilent, American Eagle Outfitters and CACI International report after the close.