Apple isn't the only American company facing the prospect of paying a big bill for back taxes in Europe.

That's the message EU Commissioner Margrethe Vestager sent Tuesday when she announced the results of an investigation that claims the U.S. tech giant owes Irish authorities some $14.5 billion bill in back taxes.

"We're sending a message to any taxpayer in Europe: This is a wonderful place to do business and invest, but you have to play by the rules," she told CNBC.

But those rules are at the heart of a simmering dispute that has erupted into a multibillion-dollar legal battle between European authorities and the U.S. Treasury, with dozens of multinational U.S. companies caught in the crossfire.

Here's what's at stake:

So the ruling shows that Apple hasn't been paying its fair share of taxes, right?

That's what the European agency behind the investigation has concluded. As evidence, they point to a 2014 tax bill that amounted to 0.005 percent of Apple's profits. That works out to about $50 in taxes for every $1 million in profits.

That's much less than Ireland's standard corporate tax rate of 12.5 percent, or about $125,000 per million.

Wow. Ireland must be thrilled to be collecting all that money.

Not exactly. The Irish government has said it will appeal the EU ruling, saying the bureaucrats in Brussels have no business telling Dublin how much they should tax companies.

Tax rates are set by individual EU members, not by the European Commission. So Ireland is essentially telling the EU to mind its own business.

That's why, for Ireland, overturning the ruling "is necessary to defend the integrity of our tax system; to provide tax certainty to business; and to challenge the encroachment of EU state aid rules into the sovereign member state competence of taxation," Ireland's Minister of Finance Michael Noonan said in a statement.

Some Irish officials see the ruling as another example of Brussels' overreach, not unlike the kind of interference that prompted British voters to choose to leave the EU.

So why is the EU sticking its nose into Ireland's tax policy?

The investigation is one of several dozen actions against U.S. companies based on a novel legal approach that defines tax breaks as "state aid." The idea is that EU member states aren't allowed to subsidize companies within their borders, because that could give them an unfair advantage against companies in countries that don't offer subsidies.

The EC ruling, in effect, said that by letting Apple pay less than the 12.5 percent other companies have to pay, Ireland is giving Apple "state aid."

Why is the EC picking on Apple?

As the third largest American company (by revenues), the tech giant is an easy target. The company took in more than $53 billion in profits in the latest fiscal year — on revenues of more than $230 billion. (That's roughly last year's gross domestic product for Oregon.)

The company is also sitting on an enormous pile of cash and other assets, valued at more than $230 billion, which it has stashed in Ireland and other countries overseas to avoid paying U.S. taxes. Many large U.S. multinational companies do the same thing, arguing that U.S. corporate tax rates are too high.

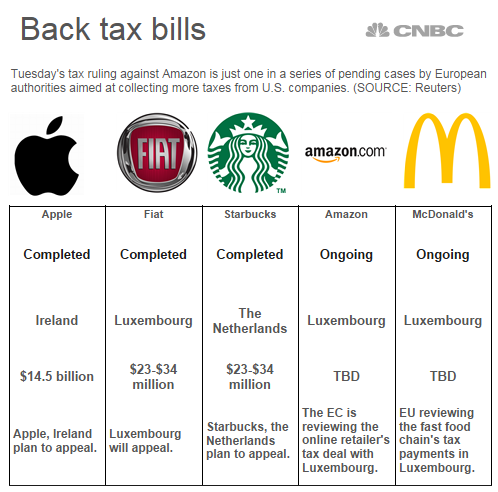

And the EC has other U.S. companies in its sights. Last fall, it said Starbucks and Fiat each owed between $23 and $34 million in back taxes. It also has tax investigations pending against Amazon, McDonald's and a number of other undisclosed U.S. companies.