Investor Leon Cooperman said Wednesday his firm's exposure to stocks is unusually low now, and some names just aren't making the cut.

Currently, he said, his Omega Advisors is only about 65 percent exposed to equities, versus its typical exposure of 85 to 90 percent. Rather than holding cash, Omega is investing in credit, with about 8 to 10 percent of his portfolio in select high-yield credits. So-called junk bonds have gained about 8 percent this year.

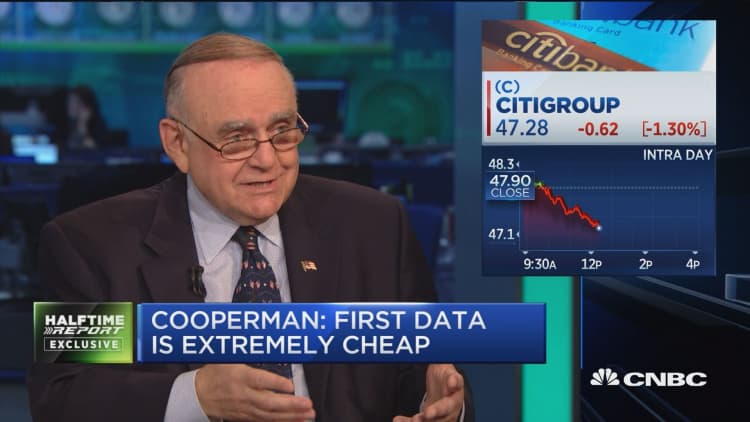

The stock market is currently "fairly but fully valued," Cooperman said on CNBC's "Fast Money: Halftime Report."

"I would not expect the market to do that much on the upside."

In the current low-growth, low-interest rate world, investors will be lucky to earn 5 to 6 percent in the stock market, he added.

Cooperman, who is chairman and CEO of the investment firm, believes the time is approaching when banks can once again turn meaningful profits, but he has dropped Citigroup to put his money to work elsewhere.

"We have a bunch of financials in the portfolio that seem a little bit cheaper than Citibank, but I think Citibank would work, will make money if interest rates will start to rise," he said.

Also gone from his portfolio: Netflix. As with Citigroup, he said there was no particular reason for the sale other than that he is "doing other things."

"I think ultimately Netflix is going to work, but I think somebody buys the company at a nice premium," he said.

Asked what it would take for Omega to buy back into Apple, Cooperman said the iPhone maker's best days might be behind it. While it generates a lot of cash, Apple could be a much smaller company in three to four years.

One name he is bullish on is credit card processor First Data. Omega estimates First Data is trading at nine times forward earnings, making it a discount in a market trading at 17 times earnings.

"Everybody is hung up on their balance sheet. The company's got $19 billion of debt, virtually no maturing debt in the next five years. However, they generate a billion dollars a year in free cash flow. It looks to us to be extremely cheap," he said.

Cooperman is also sticking by his top holding, Google-parent Alphabet, which he says has a "fortress-like" balance sheet and a creative, innovative management team.

"It doesn't take any special intellect to be long Google," he said.

The airline sector as a whole looks good, thanks to stable fuel costs and "ridiculousy low" multiples, in Cooperman's view. United Continental Holdings in particular is attractive because it trades at 5.2 times what Omega expects the company to earn next year and looks poised to buy back 8 percent of its stock, he said.

In the retail space, Cooperman said he likes Speedo and Izod-parent PVH. The company is growing two to three times faster than the broader market, and its stock could trade at 14 times next year's earnings, he said.