Technicals and fundamentals are Jim Cramer's key tools to determine when a stock is ready to explode.

"Typically, when a stock gets overbought it is ripe for a pullback because overbought stocks, ones with many buyers reaching to take in supply, tend to snap back after they have gotten too far away from their longer term trend line," the "Mad Money" host said.

Investors can determine if a stock is overbought or oversold by charting the ratio of higher closes, also known as the relative strength index, or RSI. This is a momentum oscillator that measures the direction that a stock is going, and the velocity of the move.

Cramer also matches the RSI of an individual stock to something else, maybe the relative strength of its sector or a larger index, and then measure the price action historically. He looks for anomalies where strength stands out, because that is a sign that there is a pending move or a change in momentum.

When you spot these highly unusual moves you may be able to strap yourself into a real moon shot

The inverse can also be true; a stock can also fall so fast that investors should expect it to snap back because it is technically oversold. These patterns are reliable indicators that a change in direction is about to occur, and are terrific action points.

So, for investors that are debating whether to buy a stock, have done all the research and find that the stock is overbought, Cramer said to wait for the inevitable pullback that almost always happens.

Sometimes stocks can even break through all of the ceilings of traditional significant measurement periods, and then stay overbought for weeks at a time. These stocks defy the notion of the inevitable gravitational pull of the old equilibrium line and can't be contained.

"When you spot these highly unusual moves you may be able to strap yourself into a real moon shot," Cramer said.

Volume is another key tool that chartists use to find pivots. It is often said that volume can be a lie detector to tell investors if a move is real or not. When there is a small move on light volume, technicians ignore it.

Chartists use volume to determine if large money managers are starting to accumulate or distribute the stock in an aggressive way.

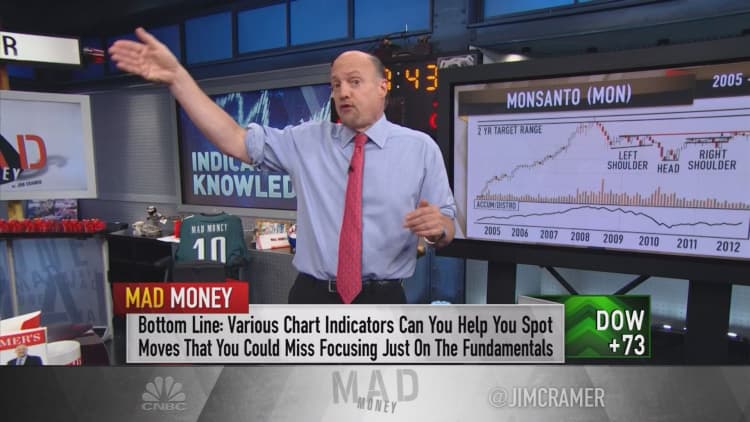

They also measure something called an accumulation distribution line. This involves charting whether a stock closes higher on greater volume on any given day, versus lower or low volume. Most brokerage firms offer this kind of charting on their websites.

Cramer saw this occur with Monsanto in July 2012. He didn't care for the stock of the company at the time. But the accumulation-distribution line showed that the stock had down days with light volume and up days with heavy volume. That was a sure sign that more money was flowing into the stock, rather than out of it.

It turns out that Monsanto's stock had started correlating with the price of corn, which was going higher because of new demand for ethanol engendered by government price supports. Cramer was too concerned about near-term earnings, and worries about a shortfall to recognize what was happening.

"Powerful moves can, and often do, elude those who are only focused on the underlying companies and not the action of the stocks themselves," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com