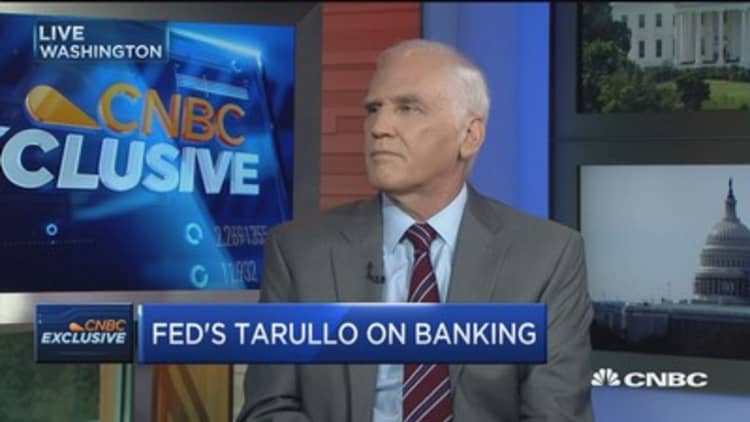

In the wake of the $190 million Wells Fargo settlement over customer fraud charges, there's an increasing need for "individual culpability" for banking infractions, Federal Reserve Governor Daniel Tarullo told CNBC on Friday.

"I don't think [bank behavior] has changed enough" since the 2008 financial crisis, Tarullo said on "Squawk on the Street," citing the Wells Fargo case, in which fee-generating accounts were allegedly opened for unsuspecting customers by employees looking to hit sales targets and bonuses. As a result, 5,300 Wells Fargo employees were fired over a five-year period.

"There is a need for a focus on individuals as well the fines on institutions. In appropriate cases, I think that fines against individuals, prohibition orders, and ... Justice Department prosecutions are things that do need to be pursued," Tarullo said.

Banking analyst Dick Bove blasted Wells Fargo, calling its behavior "beyond outrageous." Bove of Rafferty Capital Markets told CNBC on Friday he's giving Wells the only sell-rating in his entire 35-bank coverage universe.

Tarullo said he couldn't comment directly on the Wells Fargo action, which was led by the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency and the city of Los Angeles.

But Tarullo did say in general: "Too many banks, instead of putting in place a comprehensive system for insuring that all their employees understand what is legal and ethical across the board, only respond when there's a particular problem."

"They really need to be much more proactive in stating their expectations across a range of behaviors to their employees," he added.

Tarullo said banks need to integrate their compliance functions like they did with their risk-management operations after the crisis.

The CFPB, which was created after the financial crisis, will get the bulk of the fine, $100 million, the OCC will get $35 million and Los Angeles will get $50 million. Customers who were victimized will get $5 million.