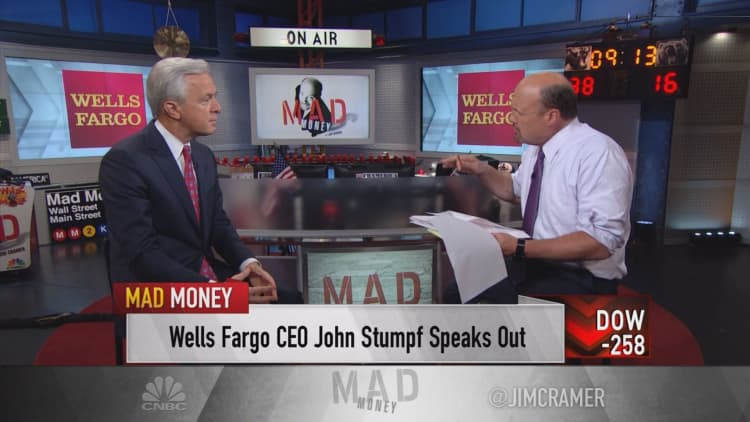

Wells Fargo CEO John Stumpf says he holds himself accountable for the alleged abusive account opening practices for his company but does not plan to resign.

"I think the best thing I could do right now is lead this company, and lead this company forward," he told Jim Cramer in an interview on "Mad Money" on Tuesday.

On Thursday, Wells Fargo was fined $185 million by the Consumer Financial Protection Bureau and two other regulators for employees opening bank accounts and credit cards that were not authorized by customers, in order to meet sales goals. Approximately 5,300 employees were fired in connection to the issue.

"We are sorry. We deeply regret any situation where a customer got a product they did not request," Stumpf said, "There is nothing in our culture, nothing in our vision and values that would support that. It's just the opposite. Our goal is to make it right by a customer every time 100 percent and if we don't do that, we feel accountable."

Carrie Tolstedt was the Wells Fargo executive in charge of the unit where employees allegedly opened unauthorized accounts. The bank announced her retirement in July, effective the end of the year. According to a Wells Fargo proxy statement, she is entitled to about $95 million in accumulated stock and options over her career, based on when the stock was trading around $49 per share last week.

Mary Eshet, spokeswoman for Wells Fargo, told CNBC that Tolstedt was not available for comment.

Stumpf did not comment on whether clawback provisions would be instituted for Tolstedt's pay.

"To the extent that is a consideration … we have a board process," Stumpf said.

Stumpf also confirmed that none of his personal compensation was tied to the product sales goals from the company, nor was compensation for any of the named executive officers.

But he said he considered himself responsible for any deviation from Wells Fargo's goals.

"To the extent that we don't get it right 100 percent of the time, because that is our goal, if we don't make that plan, I am responsible. I am accountable. Anybody else in the company, we all feel when we fall short of that plan, we feel accountable and responsible. And we are taking action."

Moving forward, Stumpf still plans to embrace cross-selling and strong customer relations for the company. What will change are the tools utilized for product sales, he said. On Tuesday, Wells Fargo announced it would remove product sale requirements for its retail bank.

"Without giving you any guidance, I believe we are a growth company. We were a growth company yesterday, we are a growth company today and we are going to be a growth company tomorrow."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com

Correction: This story was revised to correct that Carrie Tolstedt will retire at the end of the year, according to Wells Fargo. It also was revised to provide a lower value of her stock and options, based on a Wells Fargo proxy statement.