Clawbacks on Wall Street? Easier said than done.

Bank analysts believe much of the pay claimed by now-departed Wells Fargo executive Carrie Tolstedt can't be taken back, regardless of how much noise Capitol Hill legislators make. Tolstedt was the head of the Wells Fargo consumer banking unit that's at the center of institution's fake accounts scandal.

For one: stock Tolstedt bought, which was not part of her compensation agreement, can't be clawed back, said Rafferty Capital Markets banking analyst Dick Bove. It's unclear how much of Tolstedt's paper gains were made from stock that she owned, but the executive departed Wells Fargo after retiring with a little under $100 million in overall stock and options from her career.

And that designation — retired, rather than fired — will make all the difference going forward.

"They did not fire her for cause," Bove noted, when asked about how the bank could go about executing clawbacks. "They have to come up with a reason she did not perform her function."

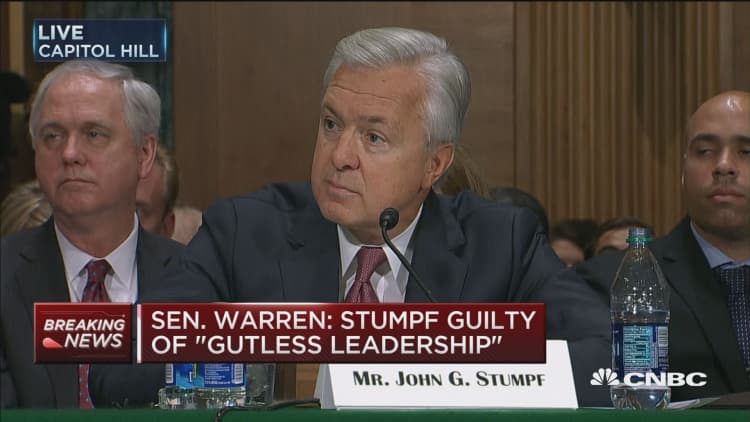

Wells Fargo CEO John Stumpf faced intense questioning on clawbacks from Sen. Elizabeth Warren on Capitol Hill on Tuesday.

"I'm asking if you have fired senior management, the people who actually led community banking division, who oversaw this fraud, or the compliance division that was in charge of making sure that the bank complied with the law," Warren said to Stumpf in a blistering interrogation.

Stumpf said that at the time of Tolstedt's departure, the bank had decided it was "going in a different direction" with her unit. Whether the bank seeks to claw back pay from Tolstedt or anyone else would depend on future findings, but a legal defense team would center on the fact that she resigned, rather than was terminated, if it came to that.

Stumpf made clear that he isn't a part of the group at the bank that decides whether to chase clawbacks: that falls to an independent group within the bank.

Within every executive contract, says Andrew Stoltmann, a securities lawyer, are provisions covering professional conduct standards. If it's determined — even after the fact — that Tolstedt violated those, the bank can try to reclaim a portion of her pay.

One analyst said he thinks Tuesday could mark the beginning of a tide turning, and that Wells Fargo may ultimately decide to pursue a clawback of a portion of Tolstedt's pay.

"They need to do the clawbacks," said Brian Kleinhanzl, a Keefe, Bruyette and Woods equity research analyst.