The Federal Reserve's holding pattern on interest rates should signal one thing to investors: start brushing up on astrophysics if you want to understand why the world's economy might be approaching a cosmic conclusion.

Like a massive star exploding into a supernova, debt is rising at a blistering pace. There is currently more than $230 trillion in global debt—that's three times the amount of debt the world held during the credit crisis.

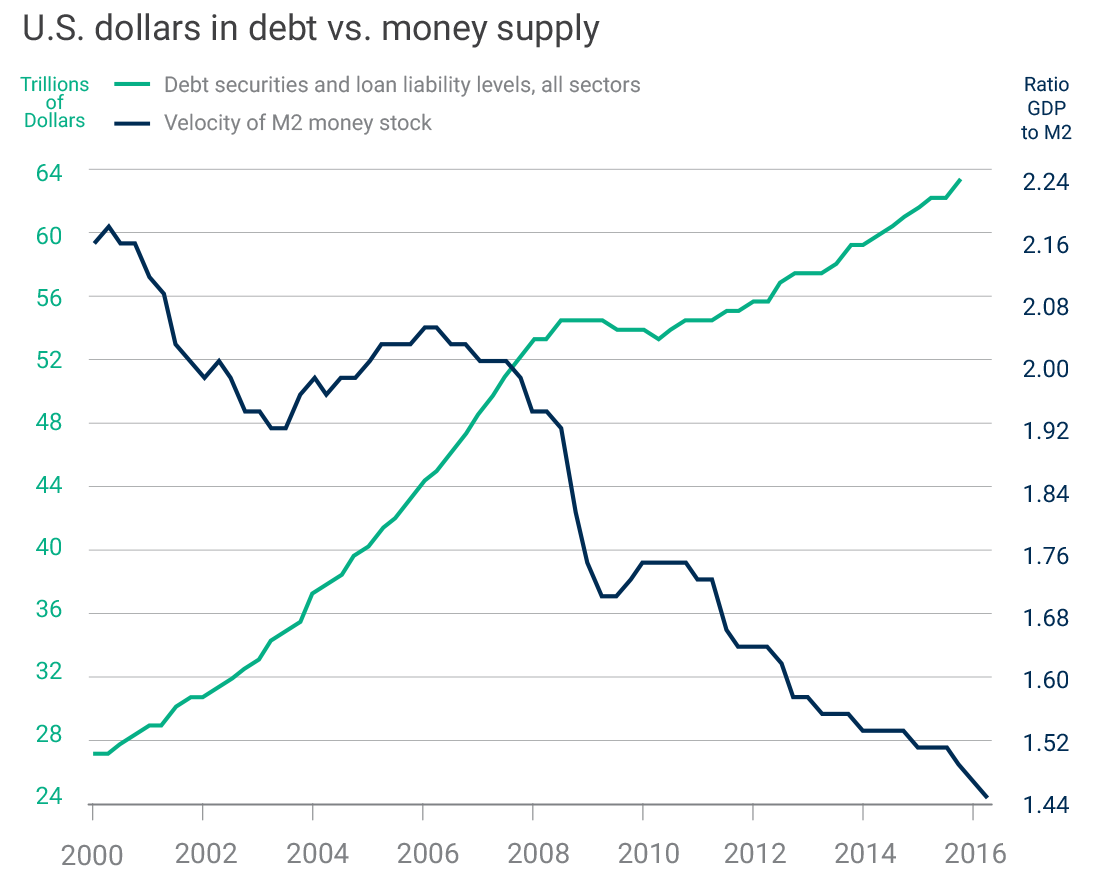

Central bank intervention has fueled this explosion in debt, including historic levels of quantitative easing, zero interest rate policies and the adoption of negative rates. In the U.S. alone, there's more than $63 trillion in combined public and private debt. In stark contrast, there are only $3.8 trillion total dollars in circulation, and each of these dollars has been lent and borrowed more than 16 times. The amount of leverage continues to climb.

At the end of every supernova comes a black hole. Black holes have such a strong gravitational effect that nothing can escape their pull. And fundamental laws of physics are distorted at the center of a black hole, also known as the gravitational singularity. We're seeing a similar phenomenon in the investment world: the crushing weight of all this global debt is distorting some fundamental economic principles.

Buying stocks for yield and buying bonds for returns

With treasury bonds yielding less than 2 percent, many investors are buying dividend-paying stocks for their yield. For 35 years, interest rates experienced a steady decline into negative territory, and today's bond investors are actually hoping rates will keep moving lower to offer their portfolio some returns. Otherwise, they're stuck paying the borrower to borrow their money.

Cash might not be the parachute investors hope it will be, either. The interest rate environment has banks and other financial institutions shunning cash. Others are charging depositors just to hold it. This dynamic has a direct effect on banks' willingness to lend capital into the real economy, distorting the money supply as measured by M2, which includes cash (M1) and short-term cash alternatives like money market funds.