Before the market gets a glimpse at the latest government jobs data each month, payroll management company ADP gives it a preview with its own monthly employment report. The metric is closely followed by the market, but the two numbers often differ by thousands of jobs.

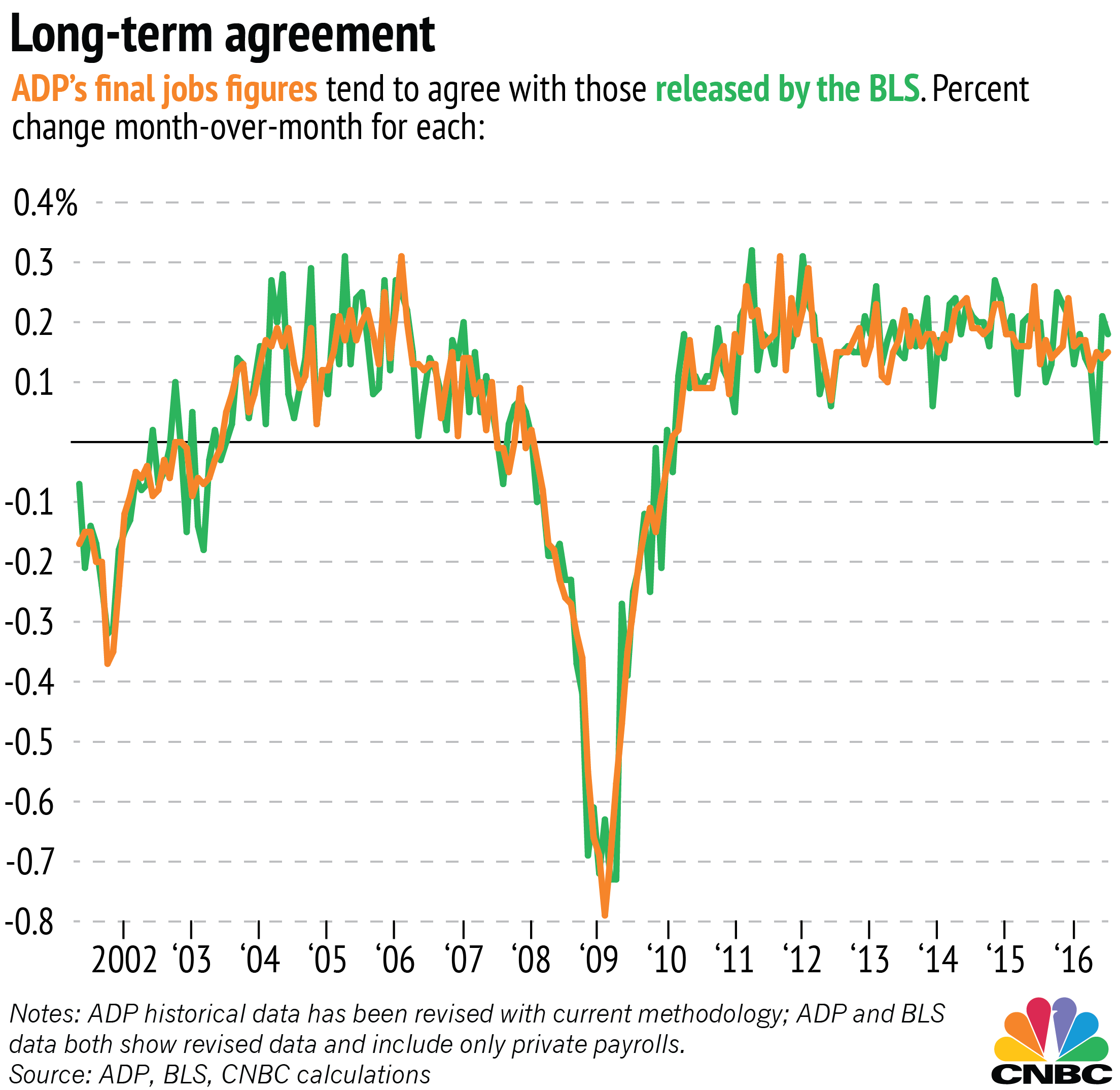

So how useful is the ADP report for predicting the Bureau of Labor Statistics figures each month? Over the long term, it's clear that the two indicators tend to fall in line, but over the short term, it's hard to look at the ADP National Employment Report figure and know exactly what's coming in the official report.

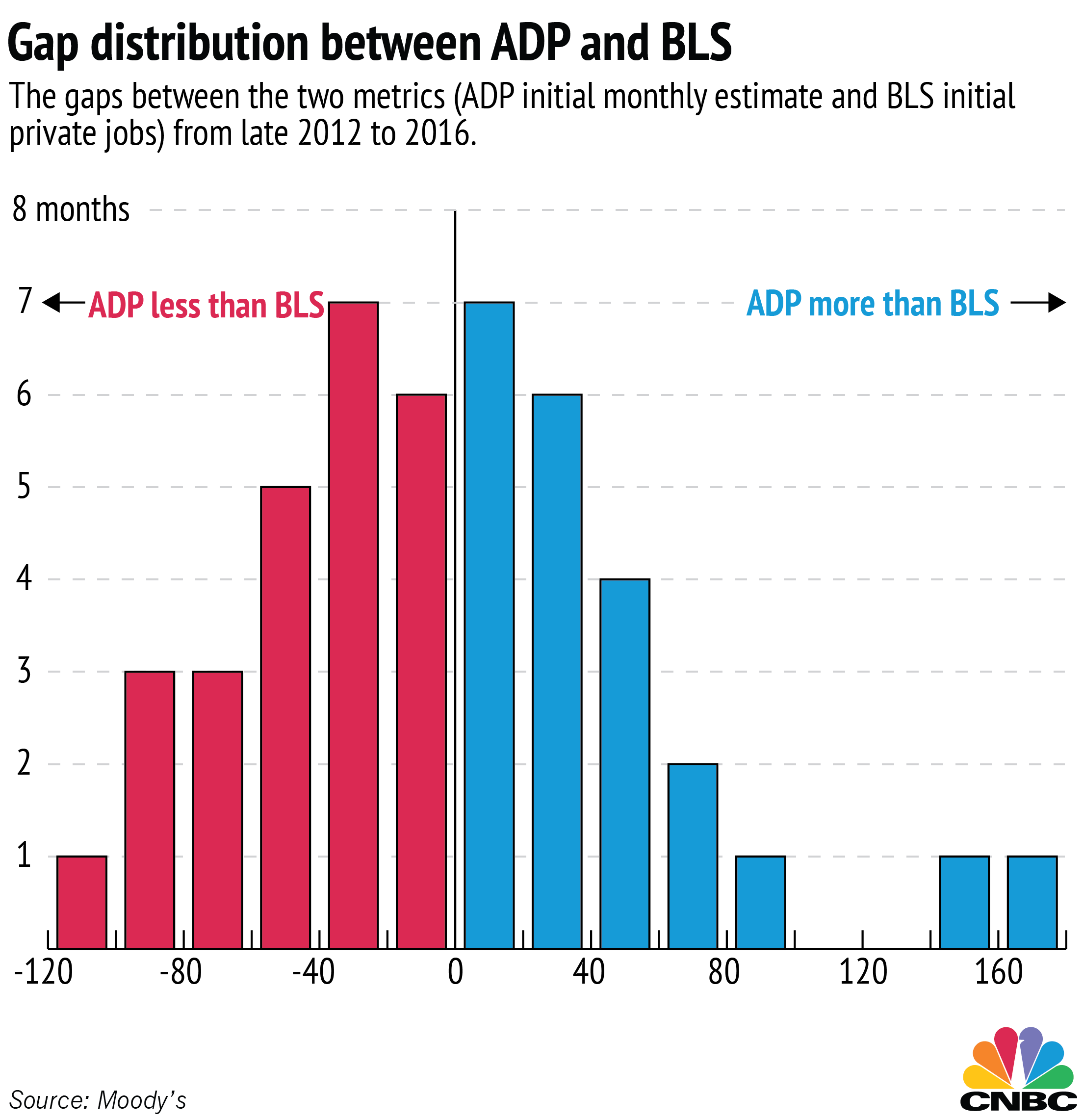

The difference between the number of new jobs reported by ADP every month and the BLS private nonfarm jobs number that comes two days later is greater than 40,000 about half the time, according to a CNBC analysis of the figures since November 2012. That means that the disappointing 154,000 figure reported Wednesday by ADP for September could easily be a healthier number near 200,000 or an anemic one closer to 100,000.