Morgan Stanley joined its Wall Street peers in the third quarter on Wednesday by easily topping profit expectations.

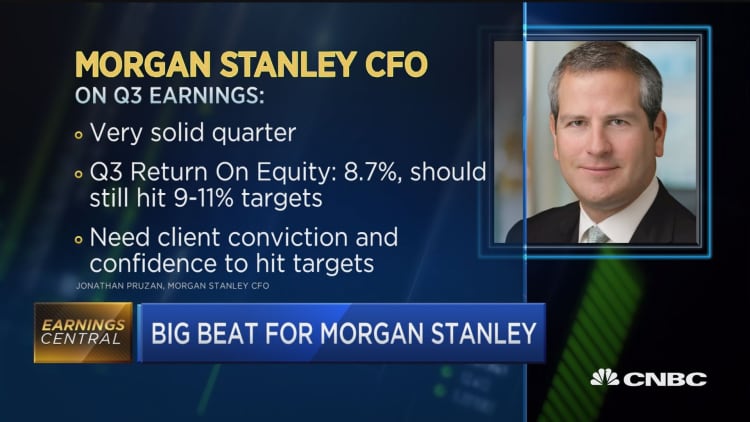

The bank posted earnings of 81 cents per share on revenue of $8.9 billion. Analysts surveyed by Thomson Reuters expected 63 cents profit and sales of $8.17 billion. Return on average common equity was 8.7 percent.

Shares gained more than 1 percent in premarket trading.

The 17th-largest bank by assets had faced challenges in trading and its fixed income, currencies and commodities operation, but that segment posted a strong quarter with revenues of $1.5 billion. Trading has been a strong point for Wall Street banks this quarter, with Goldman Sachs, Citigroup, Bank of America and JPMorgan Chase all reporting strong growth.

Morgan Stanley was the last of the big Wall Street banks to report earnings.

Morgan Stanley earnings for the same period in 2015 were 34 cents per share, putting this quarter's gain at 139 percent.

"This quarter we saw record revenues in wealth management and a strong performance in our sales and trading business. While the environment was more challenging for our equity underwriting and asset management businesses, our expense initiatives remain on track," Morgan Stanley CEO James Gorman said in a statement. "Overall the results reflect steady progress against our long term strategic goals."

Morgan Stanley's earnings were expected to get a boost from the bank's role in Microsoft's acquisition of LinkedIn, a $26.2 billion deal that has been part of a recent uptick in deal volume. Morgan Stanley shares were up about 1.5 percent year to date as of the end of trading Tuesday.

Indeed, investment banking was a strong source of revenue in the quarter at $1.1 billion, in line with estimates. Wealth management revenues came to $3.9 billion, slightly ahead of expectations, while wealth management missed with $552 million, against a $590 million estimate.

Analysts have been watching bank earnings closely for the effects of the Brexit vote in particular and market volatility in general. The U.K. vote in June to leave the European Union was expected to destabilize the financial system but thus far has mostly affected the British pound sterling.

Banks are hoping the Federal Reserve hikes rates soon.

Eight years of near-zero funds rates have hurt bank margins, and the sector has broadly underperformed the rest of the market. The KBW Nasdaq Bank index is down about 1.8 percent year to date, though the sector has beaten the market lately. Banks are up 6.4 percent over the past three months.

Morgan Stanley said it repurchased about $1.25 billion worth of its own stock during the quarter.