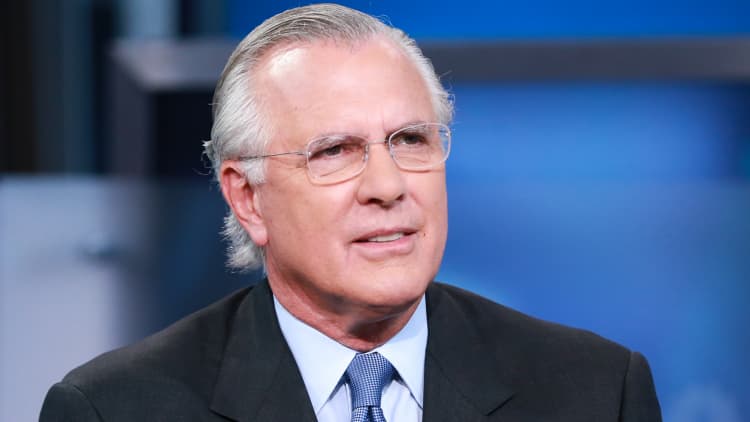

Unconventional monetary policy that has squeezed the middle class helps explain Donald Trump's improbable political journey, according to former Dallas Fed President Richard Fisher.

Looking at the current political situation causes Fisher to "weep for my country," the ex-central bank official said last week in a speech to the Urban Land Institute's fall conference. A transcript of the remarks was included Thursday in a note from Doug Kass of Seabreeze Partners Management, but the speech has seen little if any exposure otherwise. (Kass is mentioned favorably in the speech for predicting a "generational low" in bond yields.)

Fisher confirmed to CNBC that he made the comments.

The speech covers a gamut of historical and fictional figures from Winston Churchill to Eva Peron to Homer Simpson in describing the despair that has arisen from monetary policy that "every banker, insurer, long term investor and business operator I know thinks ... is becoming a fool's game."

Small wonder that we have ended up at a political crossroad, with a choice for the presidency between a candidate who advocates having government distribute still more to ease the pain and another arguing to provide relief by changing gears entirely, though we know not how, when or where.Richard Fisherformer Dallas Fed President

Fisher argued in the past that low rates and money-printing were distorting market values and severely hurting savers, but the Fed has kept the pedal floored on easy monetary policy since the financial crisis.

"I was therefore not the least bit surprised by the rise of Donald Trump or movements similar to his elsewhere, just, as anybody who I advised before June 23 knew I was not surprised by Brexit," he said.

Global monetary policy has "skewered the middle-income groups, the 'middle class,' adding to the angst that has sprung from their sense of an overbearing, intrusive central government."

"Small wonder that we have ended up at a political crossroad, with a choice for the presidency between a candidate who advocates having government distribute still more to ease the pain and another arguing to provide relief by changing gears entirely, though we know not how, when or where," Fisher added.

Fisher cited the zero and negative interest rate policies, along with trillions worth of money-printing known as quantitative easing adopted by the Fed and its global counterparts as measures that have spurred wealth inequality and increased economic and market risks.

"These schemes, coupled with the mere force of limitation of a feckless political class that can't contrive fiscal and regulatory policy that creates jobs and fosters economic prosperity, has put us in the present unhappy presidential predicament we are confronted with," he said.

The remarks come during the final days of a brutal presidential campaign that has seen vicious charges and counter-charges come from both Trump and his Democratic opponent, Hillary Clinton.

Clinton continues to hold a modest lead in most polls, but the race is getting tight in the final five days. Perhaps more telling, though, is that both show negative ratings at historic levels for presidential candidates.

Fisher believes that is no accident, considering the current climate.

"My more acerbic friends on both sides of the aisle consider it a Hobson's choice," he said, referring to a situation where it seems there's free choice but in reality there's no good alternative. "On the one hand, Republicans believe the other party's candidate is channeling Eva Peron, planning policies that will ultimately lead us down the Argentine path to economic ruin while basking in personal profit and glory. On the other, Democrats liken the Republican candidate to Caligula."

More particularly, he said the rise of populists like Trump and Vermont Sen. Bernie Sanders, who challenged Clinton during the primaries, is a revolt "against monetary policy that cripples their savings and spending power, taxes that strip them of what they earn by the sweat of their brow or the strength of their back, and regulations that dictate their behavior where they work and live and study, tend to their medical needs, and even worship."

While Fisher said he fears the direction the country is heading, he closed the speech on an optimistic note.

"We may well be poised for a financial markets reversal. We may well be on the eve of a political debacle," he said. "But we are Americans. We screw things up pretty badly, pretty often. But, as Churchill said, after trying everything else, we eventually do the right thing. We will have no choice but to do it again."