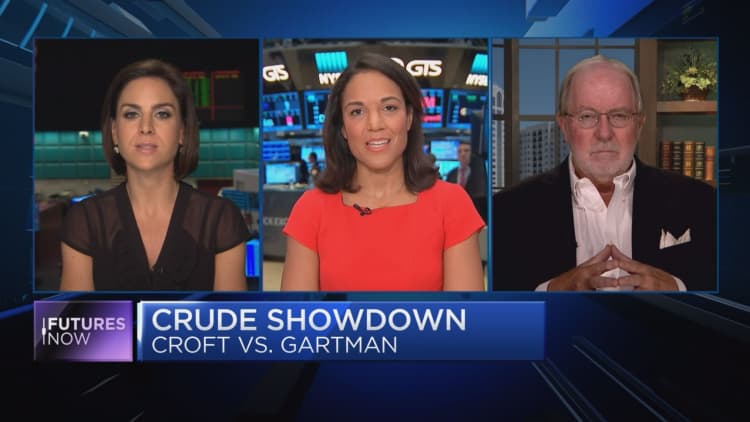

Call it a crude show down for the ages.

Two of the most respected commodities experts on Wall Street duked it out recently over oil's next stop, and whether OPEC would be a catalyst for driving prices higher or lower.

In one corner, "Commodities King" Dennis Gartman maintained that OPEC cheats and that the word of the cartel should not be trusted.

In the other corner, Helima Croft of RBC Capital Markets reiterated that the Organization of the Petroleum Exporting Countries will strike a deal, which will ultimately drive the price of crude higher.

"It's going to be very difficult to get WTI much below $40," Gartman told "Futures Now" last week.

However, while he noted that a panic liquidation could driver prices towards $38, Gartman maintained that $52 oil would be a difficult target to achieve given the current climate. "We may well be stuck within a broad range. Call it $38 on the low side and $52 on the high side."

Following a segment on CNBC on Tuesday, Gartman again cast his doubts over OPEC's rhetoric and emphasized that the cartel, "cheats no matter what happens. They have no choice. And I think that cheating, which has been endemic to OPEC since its inception, will simply continue."

Croft, who has been bullish on oil throughout the course of 2016, took issue with Gartman's assessment of OPEC's practices.

"We remain convinced that OPEC will stick this landing," explained RBC's Global Head of Commodity Strategy, ahead of the upcoming OPEC meeting on November 30th.

"Yes, left to their own devices, OPEC countries will cheat. But, what I think is different this time is that almost all of the OPEC countries are flat out producing."

Given the current levels of production, Croft said Iraq likely doesn't have many more barrels to put on the market. Additionally, she noted a drop in production for Venezuela.

The one wild card appears to be Saudi Arabia, the world's largest oil producer. Croft insisted the Kingdom is ready to play ball.

"Saudi Arabia wants this deal to fly because of their own domestic priorities," explained Croft in regard to how the nation's economy is largely dependent on steady oil prices.

Specifically, with plans to take Saudi Aramco public, the Kingdom can't afford volatility in the coming year as the offering could be worth as much as $2 trillion in a stable market.

"I expect them to get the deal done. If Venezuela could cheat, they would, but I think they're all out of bullets at this point," Croft said.

Croft added that, while the price of oil could head lower before the meeting thanks to widespread skepticism and bearish headlines, her firm is firm on its call for $60 oil.

However, the trend has not been RBC's friend lately. West Texas Intermediate slid to a low below $44 last week, its weakest since September and down nearly 10 percent in a week.

With this in mind, Gartman had to respectfully push back on Croft's views. He drew attention to the words of Mohammad bin Salman Al Saud, the Saudi Deputy Crown Prince, who recently said that his nation's oil becomes a spoiled asset if they don't continue to produce and sell it at competitively.

Given the abundance of crude out of Riyadh, Gartman noted it wouldn't be unheard of if they put an additional million barrels on the market each month.

"I don't think Saudi has an additional million barrels," Croft fired back after referencing the nation's output in July, which was largely regarded as peak production at 10.65 million barrels. "Saudi Arabia is the one that switched their policy. They are the ones now begging Iran, and now exempting Iran [as well as Nigeria and Libya], because they want this done."

Given the Saudi's reported desire to strike a deal, Croft anticipates that they'll in fact drop production below the January levels of 10.2 million, while allowing rival nations to continue producing at near-record levels.

Furthermore, Croft believes that Saudi Arabia is in the driver seat because Gulf nations like Quarter, UAE and Kuwait historically follow the example set by Saudi Arabia when it comes to production.

According to International Energy Agency, oil supply is expected to outpace demand through the first half of 2017. That said, Gartman admitted that a potential deal could emerge in Vienna later this month.

Still, "all I can do is remain bearish of crude oil. As long as informed money is moving in one direction, I shall move in that direction," Gartman argued.