Donald Trump has the potential to be a massive force for good for the economy.

The story of the American economy in the past eight years is one of tension between an aggressive "monetary" policy and a nonexistent "fiscal" policy.

Monetary policy has come from the Fed lowering interest rates to nearly zero in an effort to pump up the economy. This policy has led to tepid growth, and essentially run its course. There is only so much the Fed can do.

Fiscal policy is a combination of reforming the corporate tax code and government spending on big projects that will pump money into the economy and create new jobs. With Republicans now in control of the White House and both houses of Congress, the years-long standoff may be broken.

President Barack Obama got a relatively wimpy stimulus package passed at the start of his term but hasn't been able to get anything going since then.

Left-wing economist Paul Krugman has been pounding the table for an increase in fiscal stimulus for years now, to no avail.

Trump could change all of this.

The first thing Trump mentioned in his victory speech was spending on infrastructure.

"We are going to fix our inner cities, and rebuild our highways, bridges, tunnels, airports, schools, hospitals," he said. "We're going to rebuild our infrastructure, which will become, by the way, second to none. And we will put millions of our people to work as we rebuild it."

During the election, Trump promised to spend heavily on programs that would create untold numbers of jobs in construction, steel manufacturing and other sectors. He said his focus would be on transportation, water, telecom and energy.

"We can work together to quickly pass a robust infrastructure jobs bill," House Minority Leader Nancy Pelosi said, according to a tweet by Jonathan Martin of The New York Times.

Beyond the infrastructure spending, Trump's economic policies include across-the-board tax cuts for individuals and a slashing of corporate taxes down to 15 percent from 35 percent.

In addition, he pledged to slash regulations that he said are burdening businesses and holding back job creation.

Finally, he said he would "repeal and replace" Obamacare, a pledge that he likely will be able to fulfill with a Republican Congress.

Economists generally have feared that Trump's spending stimulus and tax cuts would increase the national debt by $5 trillion or more. They also believe his fiery rhetoric about currency manipulation and tariffs could spark a trade war.

But Trump has maintained that economic growth would more than compensate and not necessitate tax hikes to pay for the infrastructure spending in particular.

And, for what it's worth, Krugman has argued that we need to increase our debt:

"Issuing debt is a way to pay for useful things, and we should do more of that when the price is right. The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates. So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation."

Trump supporters believe Trump can do all of this in a responsible way.

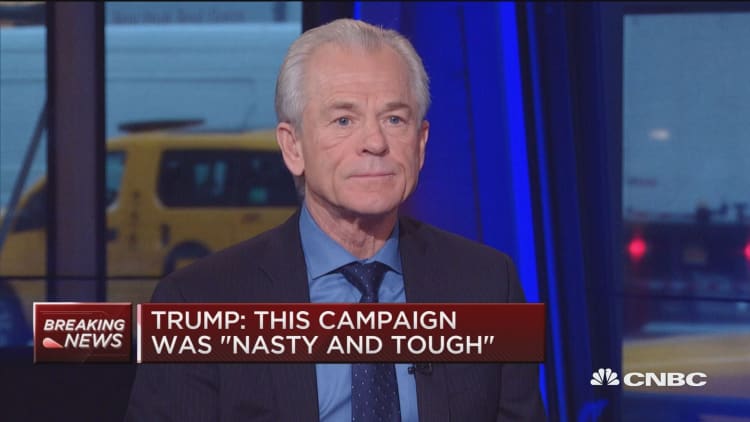

"That plan is revenue-neutral because it uses a very innovative system of tax credits to help with all the other sources of funding we have. The last thing you want to do is raise taxes to fund an infrastructure program," Peter Navarro, a senior policy adviser to Trump, told CNBC. "That will not happen in a Trump administration."

"Everything that Mr. Trump is going to do points in the direction of growth," he added.

Markets initially reacted with shock at the Trump win, sending Dow futures plummeting 800 points at one point overnight. But given the chance to digest the road ahead, the stock market recovered, with the blue-chip index turning positive in morning trading.

On the commodities markets, which are perhaps a bellwether for economic growth ahead, prices rallied. Copper — or "Dr. Copper" as it is often called for its predictive abilities — surged as much as 3 percent.

"Let us not forget that the key constant in Trump's election campaign was to continually surprise the public," Stefan Kreuzkamp, chief investment officer at Deutsche Asset Management, said in a note to clients. "It is entirely possible that after his election, he could in fact surprise markets on the positive side."

There are, of course, other nonpolicy things that can impact the economy. The biggest concern for anyone banking on an economic shot in the arm has to center on Trump's foreign policy.

How will Trump react when a foreign power tests him militarily? We have no idea.

But, if we simply look at what Trump can do for the economy based on fiscal policy changes there is reason to be optimistic that he can help the economy.