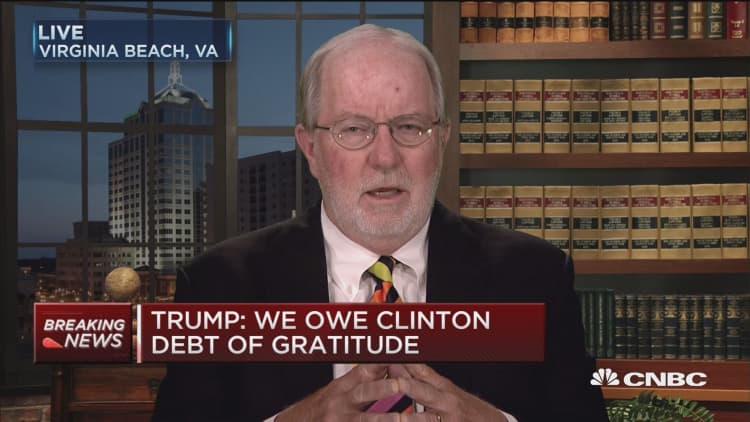

When it comes to the commodities market, copper, steel, coal and gold could be among the winners from the U.S. election, Dennis Gartman, founder and editor of The Gartman Letter, said Wednesday.

"I think the world was not prepared for Mr. Trump to win this," Gartman told CNBC's "Squawk Box." So money is fleeing to safer havens — it's going to gold, it's going to the Japanese yen."

The U.S. dollar fell 0.6 percent against a basket of currencies on Wednesday, while gold futures were up 2.3 percent in early trading. The precious metal spiked overnight as stock futures tumbled after Donald Trump clinched a surprise victory in the U.S. presidential election.

Many commodity futures are affected by strength in the dollar, in which they are priced. In a research note to clients, Capital Economics revised up its forecast on bullion, expecting it to hit $1400 per ounce by year-end, and $1450 by the end of 2017.

"I think that we're going to see the dollar become a good deal stronger because of this," Gartman said. "I do think that Mr. Trump tends to be somewhat of a trade protectionist. Who's going to be hurt by that? It's going to be the Europeans. It's going to be Germany, that depends so much upon trade exports."

Gartman earlier told CNBC he had voted for Trump, but he was "fearful" of the movement toward trade tariffs.

"I think the benefit goes to the gold market because of uncertainty," Gartman said. "I think that's going to happen rather consistently."

Trump ran on a platform of investing in new infrastructure, including "thousands of new jobs in construction, steel manufacturing and other sectors to build the transportation, water, telecommunications and energy infrastructure." Gartman said that could benefit metals like steel and copper, considered an economic bellwether because of its broad industrial applications.

"The new president is going to be far more expansionary when it comes to energy," Gartman said. "That's going to be helpful to the suppliers of the production of crude. It's going to be detrimental to the crude's price itself."

During the campaign, President-elect Trump's energy plan focused on expanding U.S. oil, gas and coal production. That effort comes as the world is still working through a global glut of crude, largely fueled by growing U.S. output, that has caused a two-year oil price downturn.

U.S. coal consumption has been declining for years as power plants shift to cleaner, cheaper natural gas. Clean air regulations enacted by President Barack Obama hastened the retirement of some coal-fired units.

"The coal industry itself has been resurrecting on its own, and it's going to do far better," Gartman said. "Coal mines will be reopened. New coal production will come on stream. Natural gas ... we will be drilling, drilling, drilling for more."

— CNBC's Tom DiChristopher contributed to this report.