Other companies have continued to operate in Venezuela, marking down exchange rate losses and production issues as they come up. Coca Cola, for example, has written down about $132 million since the beginning of 2015 and has warned that future write-downs are also possible if the situation continues to worsen. The company slowed production in a few markets due to sugar shortages.

"The most extreme example perhaps is Venezuela, where there was no sugar," President and COO James Quincey said in a July conference call. "We've actually doubled down on really driving Coke with zero sugar in Venezuela with a kind of full red One Brand look."

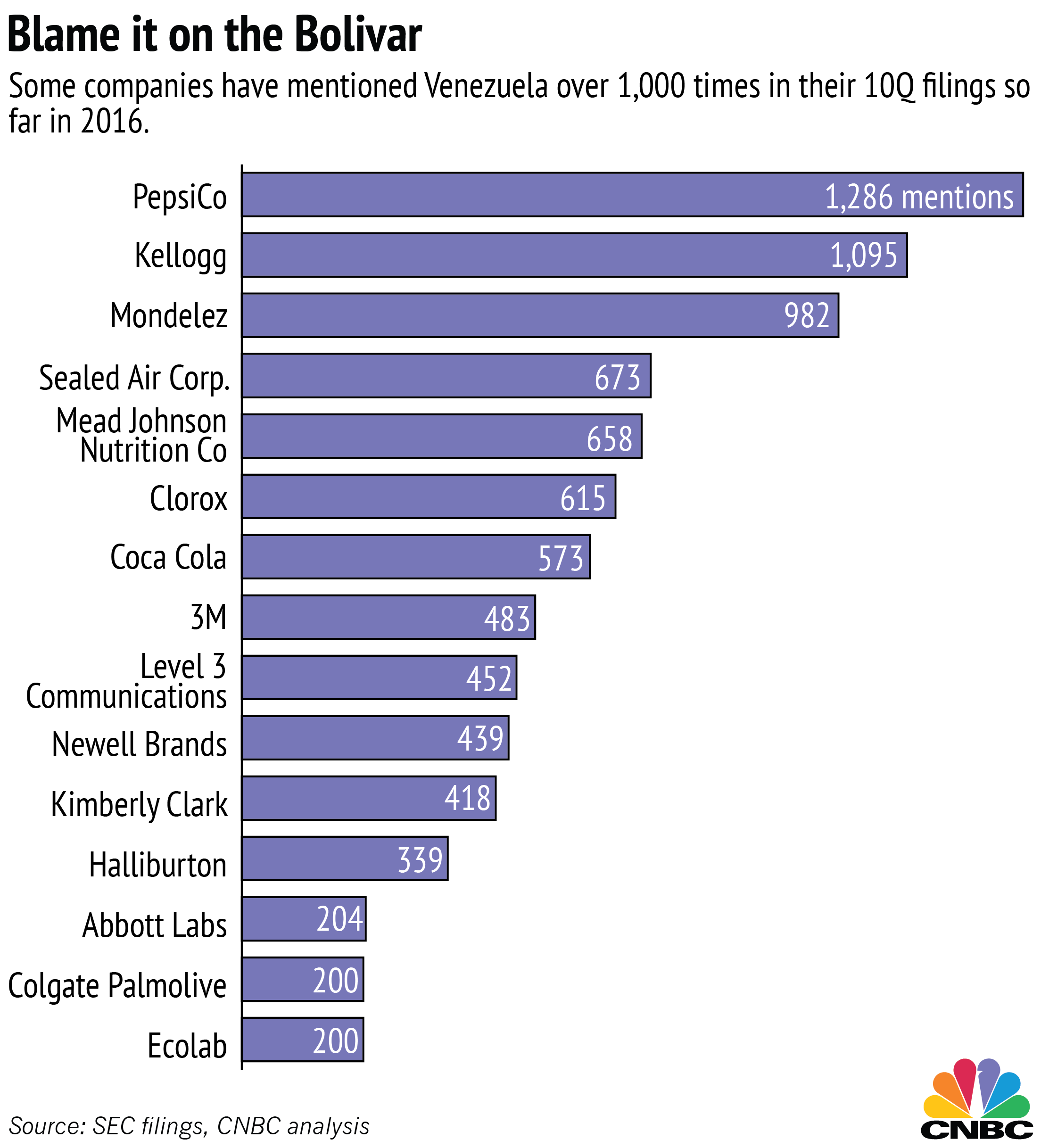

Kellogg said that currency swings cut the company's operating profits by $132 million last year and could cut 10 cents off earnings per share in 2016, with much of that impact coming from Venezuela.

Some oil field services companies, like Schlumberger and Halliburton, remain in the country, but have curtailed their operations due to late payments.

In July, Halliburton reported that it had taken a $148-million writedown in accepting a promissory note for unpaid invoices from its "primary customer in Venezuela." The filing did not specify that customer by name, but state-owned PDVSA is the only company that operates in Venezuelan oil fields, according to Reuters. In an October note, analysts from Nomura said Halliburton had received its first cash interest payment on that promissory note.