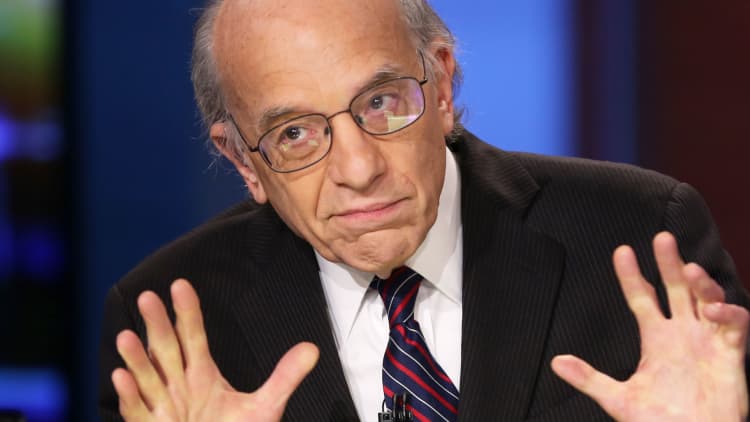

President-elect Donald Trump's victory is the sole reason the market is hitting new highs, and the rally "has a while to go," Wharton finance professor Jeremy Siegel told CNBC on Tuesday.

"When you have all the smalls stocks, large stocks, even tech stocks — which we know have had some challenges — joining with it, I don't think this is something that ends tomorrow. I think it continues through December," he said in an interview with CNBC's "Closing Bell."

Siegel had predicted a Trump win would cause uncertainty that wouldn't be good for the markets in the short run, but said in the long run the Republican's victory would be positive for stocks.

"I never thought the short run would be six hours long," he said. "I thought it would last at least a week or so."

Dow futures plummeted after Trump's win, but the markets quickly recovered and surged the day after the election, Nov. 9.

The rally has continued over the two last weeks and on Tuesday, stocks closed at all-time highs, with the Dow Jones industrial average ending above 19,000.

Siegel thinks Dow 20,000 is "not impossible," noting that so far Trump has been acting moderate.

"As long as he doesn't launch a trade war," everything is favorable, he said.

And while Trump has called for slashing the corporate tax rate from 35 percent to 15 percent, even a reduction to 25 percent would boost earnings by 10 percent, Siegel said.

"That is huge," he noted.

Kenny Polcari, director at O'Neil Securities and CNBC contributor, also thinks the market has room to run, although he would certainly look at some sectors and take profits.

"Overall if [Trump's] economic policies, if any of it comes out to be true, I think we're set up for a great rally as we move forward," he told "Closing Bell."

For those who want to buy into the market, CNBC market analyst Steve Grasso advises to not make it complicated. He suggests buying an ETF.

"If the market comes in, you're looking long term, you buy the market again. If it trades up higher, I'm a big fan of buying on momentum," the director of institutional sales at Stuart Frankel said in an interview with "Closing Bell."

Bruderman Brothers CEO Oliver Pursche would look at what types of policies will come out of the Trump administration and then he would see what industries gain the most from those policies.

Right now it looks like energy is a big winner, as well as large-cap pharmaceuticals and insurance companies in the health-care space, Pursche said.

However, he cautioned not to get carried away.

"You certainly want to be careful," he said. "The herd mentality can change very, very quickly."

And when it comes to fixed income, Pursche said he would be careful about shorting bonds or getting out of the bond market all together.

"Stick with high quality and shorten your duration. The bond market isn't going to collapse overnight. It's going to take a long time," he said.