General Electric is in the midst of a massive transformation and the clock is ticking.

After more than a decade of stock underperformance, investors and analysts are ready for a turnaround — and the industrial heavyweight continues to promise one.

"We're forecasting 3-5 percent organic growth, 100 basis points improvement. Good backlog, good momentum," said Jeff Immelt, chief executive and chairman of GE, in a recent interview with CNBC's Jim Cramer. "I like the way we're positioned in 2017."

The comment came on the heels of challenging questions about its recently disappointing quarterly performance. Immelt added, "You're going through all the bears."

That may be true. But there are bears and perhaps for good reason.

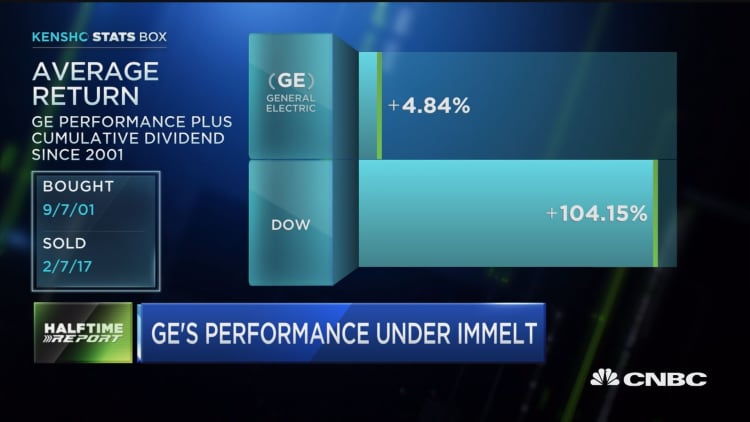

Right now, GE shares are poised to show a five-week decline. But looking farther back, since Immelt took the helm on Sept. 7, 2001, the stock has dramatically lagged the market. On a price basis, it's down more than 25 percent; factoring in accumulated dividends, the stock's up about 7 percent, according to Kensho. But the Dow Jones industrial average has more than doubled during that time.

To be fair: that period was marked by a number of big financial and geopolitical events, including the 9/11 terrorist attacks (four days after Immelt became CEO) and the financial crisis, which directly impacted GE.

Immelt acknowledged it. He also insisted that it's changing, that shares outperformed both the and the XLI Industrial ETF over the past two years, even the past five (presumably, factoring in dividends). That's because, as he points out, GE is a very different company than the one he inherited — one that no longer gleans more than half its profits from banking.

That corporate makeover means 65 percent of the revenue the CEO inherited from his predecessor Jack Welch was divested.

GE Capital was the biggest of those businesses it shed. The company siphoned off $197 billion worth of assets since announcing its financial services exit plan in April 2015, when Immelt unveiled plans to restructure GE as a pure-play industrial operation with a focus on tech.

The plan attracted the interest of one very high-profile activist investor: Nelson Peltz's Trian Fund, which made a big $2.5 billion bet to amass a nearly one percent stake that same year.

The firm declined to comment for this story, but in October, Peltz told CNBC the company has the "best set of industrial assets on the planet", shrugging off concerns of a disappointing third quarter at the time and expressed plans to stay with GE a "long time."

Immelt laid out a three-year timeline to pull off this massive corporate restructuring. Nearly two in, the results have been something of a mixed bag.

The divestitures have fetched the prices expected and they've proceeded ahead of plan. In October the company said it would merge its hard-hit oil and gas unit, which has pressured earnings amid the energy downturn, with Baker Hughes to form the second largest oil field services firm in the world by revenue. Also, its hefty $321 billion order backlog represents 10 quarters of future revenue, and margins are expanding.

Not to be overlooked: the dreaded "sifi" designation is gone, lifted by federal regulators in 2016 as the company offloaded assets. The "systemically important financial institution" label meant the company, with its banking and financial services business, was "too big to fail," thus deserving of stricter regulatory oversight and tougher capital requirements.

It's all promising, but other key metrics continue to elude the company. GE trimmed its guidance for 2016 in the fall, making mixed fourth-quarter results more disappointing. Wall Street continues to hone in on subpar free cash flow, which analysts say lags peers. Revenue has missed expectations 10 of the past 13 quarters — and actually, missed half the time since fourth quarter 2001.

"Everyone has magnifying glass on quality of earnings," says Deane Dray, a managing director at RBC Capital Markets. "The more disclosure given, the more apparent there's more work to do."

"If I was giving a report card to GE, maybe a C over the past 5 years," says John Eade, president and senior analyst at Argus Research. "GE is pretty challenged by its size, it can be hard to move the needle on growth given its market cap."

Still, both have buy ratings on the stock.

To be fair, the entire sector's emerging from an industrial recession — and analysts do say GE is poised to benefit from improving market conditions. The Alstom power business, acquired last year, is expected to become a profit power-house by 2018.

Not to be overlooked, there also is its big bet on tech that's spurred clever TV commercials, led to the coining of he term "industrial internet of things," and is expected to help shape the next generation of manufacturing, with technologies like 3-D printing and apps built on a software platform.

"Part of the change is the transformation to a digital industrial company," said Dray. "It's all new. There's no blueprint that we can follow on how companies have done that, and it looks like they have head start."

GE said these orders are growing at a double-digit rate and it expects its Predix operating platform to pull in $4 billion in revenue by 2020. But that's still small potatoes compared to other business segments within the industrial giant.

Nonetheless, it all speaks to the huge transformation underway for a 125-year old company with ties to Thomas Edison and a $260 billion market cap. And none of that factors in what pro-business President Donald Trump and his tax reform, regulation reform and infrastructure spending plans could ultimately mean for the global company, which is also a $20 billion net exporter.

It shapes the likely final chapter in Immelt's long tenure, which is widely expected to come to a close by 2021, when the chief executive turns 65 and his time at the helm hits the two decade mark.

"We've laid out a plan to do aggressive cost take down. We've got strong organic growth. Between the buyback and the acquisitions, good boost to earnings per share," Immelt told CNBC. "Our EPS last year was above the XLI. Our organic growth was above the XLI. So again, I like the way the company is positioned this year."

But the question investors are asking now: can he finally deliver, and in doing so, carve out a legacy he'll be willing to retire on. Time and a series of earnings reports will tell.