The man often hailed as the original 'Dr. Doom' is warning investors that the U.S. stock market is vulnerable to a seismic sell-off—one that could start any time in a very unassuming way.

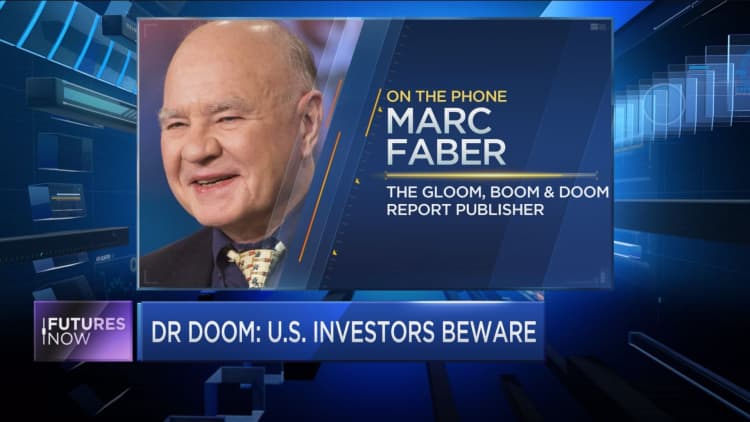

Marc Faber, the editor of "The Gloom, Boom & Doom Report," predicted the rally's disruption won't be caused by any single catalyst. His argument: Stocks are very overbought and sentiment is way too bullish for the so-called Trump rally to continue.

"Very simply, the market starts to go down. As it goes down, it will start triggering selling, and then it will be like an avalanche," said Faber recently on "Futures Now." "I would underweight U.S. stocks."

Faber, a supporter of President Donald Trump, isn't blaming the new administration for his bearish forecast.

"One man alone, he cannot make 'America great again.' That you have to realize," he said. "Trump, unlike Mr. Reagan, is facing huge, huge headwinds — including a debt to GDP that is gigantic, as it is in other countries."

Faber lists interest rates going up, as well as earnings and margins at record levels, as additional risks to the historic rally.

The Dow Jones Industrial Average registered its eleventh record close in a row on Friday. And, if you take a look at just the in February, it's on track to see the fewest declines in any month since May 1990.

It's not just the U.S. market that's been picking up big gains so far this year, however. Faber points out markets in Mexico, Brazil and Asia have been up ten percent or more.

But he's not predicting gloom and doom for all countries which have been benefiting from a strong run.

There are areas overseas which are in much better shape than the United States, according to the notoriously bearish investor.

"China looks quite attractive," said Faber. "For the next three months, money can flow into China. The economy, surprisingly, has begun to do quite well. We see that in retail in Hong Kong. We see that in the hotel industry, and we see that in the demand for commodities."

According to Faber, resource commodities such as copper and gold could also give investors solid profits this year.

"When you look at Trump and his administration, and the way the budget is, I think further money printing down the line is inevitable," he said — a policy which would could lift commodities even higher.