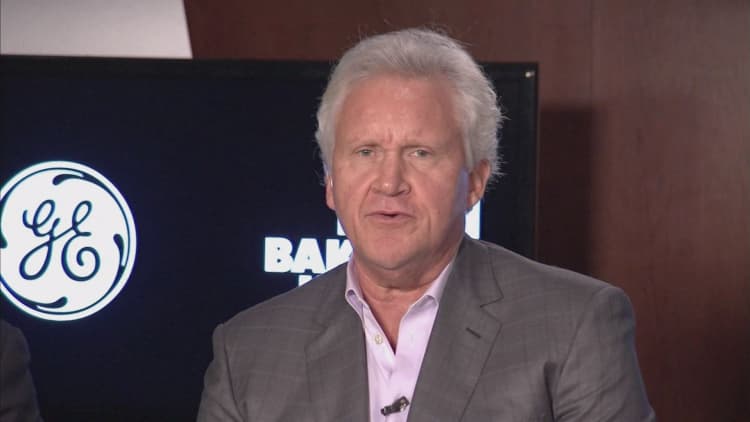

Shares of climbed more than 2 percent on Friday, following reports that CEO Jeffrey Immelt is being "pushed into early retirement."

Shortly after noon, Fox Business reported on air that Immelt was feuding with activist investor Nelson Peltz of Trian Partners.

@CGasparino: Trian non denial of my @generalelectric/Immelt story: "Trian and GE continue to work constructively together to optimize shareholder value."

Fox Business reported that the network learned from sources that Trian's Peltz was after Immelt because he was "concerned about [GE] missing recent earnings targets."

The Fox Business reporter said that asset management firm Trian was weighing whether it would begin "corporate activism" if GE didn't reach earnings targets or begin to beat the , based on what the network learned from sources.

According to its latest filing with the Securities and Exchange Commission, Immelt received a $21.3 million compensation package last year, down 35 percent from the prior year.

GE had no comment on the report.

Shares of GE were on pace Friday afternoon for their best day of the year, dating back to Dec. 1, when GE gained 2.05 percent. Trading volume was more than 21 million shares, approaching the stock's 30-day average of 28 million.

An uptick in stock price comes as a report was issued Thursday by the Institute on Taxation and Economic Policy, a left-leaning research group in Washington, claiming that 100 corporations, including GE, paid no taxes in at least one year between 2008 and 2015.

The report also says that GE incurred a total federal income tax bill of less than $0 over that eight-year period, implying the company actually "received rebates."

"This report is deeply flawed and misleading," GE spokeswoman Tara DiJulio said Friday in a statement to CNBC. "GE is one of the largest payers of corporate income taxes."

Over the past decade, GE has paid more than $32 billion in cash income taxes globally, DiJulio said, and has paid more than $1 billion annually in U.S. federal taxes alone.

"The tax code is complex and outdated, which is exactly why tax reform must happen this year," she added. "GE has long been advocating to simplify and modernize the tax system — even if it means we pay more in taxes."

Watch: Immelt says good talks with Trump