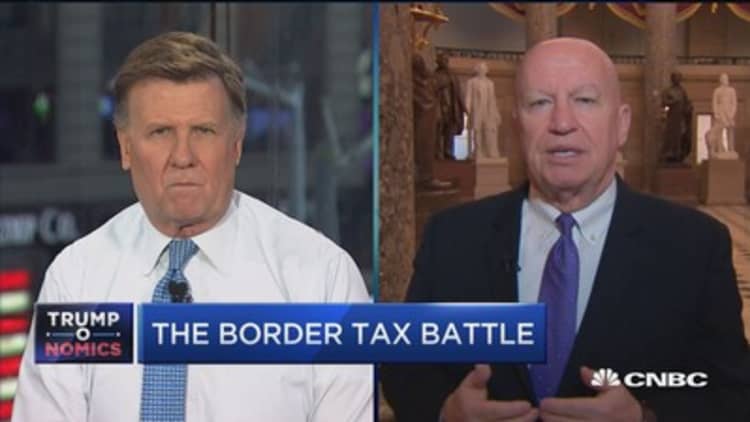

A border adjustment tax will probably make an appearance in the final tax reform plan, the Republicans' chief tax writer in the House of Representatives, Rep. Kevin Brady, told CNBC on Tuesday.

"My sense is that border adjustability has become a given. That it will be part of the final tax reform plan and now the discussions are how can it be designed in transition in a very positive way for importers," the chairman of the House Ways and Means Committee said on "Squawk Box."

"Because for the rest of businesses, and I would say for importers as well, looking at this strong economy, taxing everyone equally in the U.S., eliminating any tax incentives to move overseas and making sure made in America products can compete around the world ... everyone wants that in the final tax reform plan," he said.

A border adjustment tax, which would levy fees on imports, is a core part of a broad tax reform "blueprint" being pushed by House Republicans, including Speaker Paul Ryan and Brady.

The retail industry is intensely concerned about the idea of a border adjusted tax because it would presumably increase the cost of the goods they import from places like Asia.

Last month, Treasury Secretary Steven Mnuchin told CNBC that the Trump administration is listening to an array of businesses that are concerned about the impact of a border adjusted tax on their profits.

"We're reaching out to business, not just big business but small- and medium-sized businesses also, and we're listening to what people have to say," Mnuchin said.

Brady on Tuesday said he does not speak for the president or the Senate. He added: "People are coming to realize that as a key component tied the lower rates, no longer taxing worldwide, the critical role that border adjustability plays in being able to leapfrog from now 31st in the world in competitiveness up to third and keeping us there for the long term is really key."

— Reuters contributed to this report.