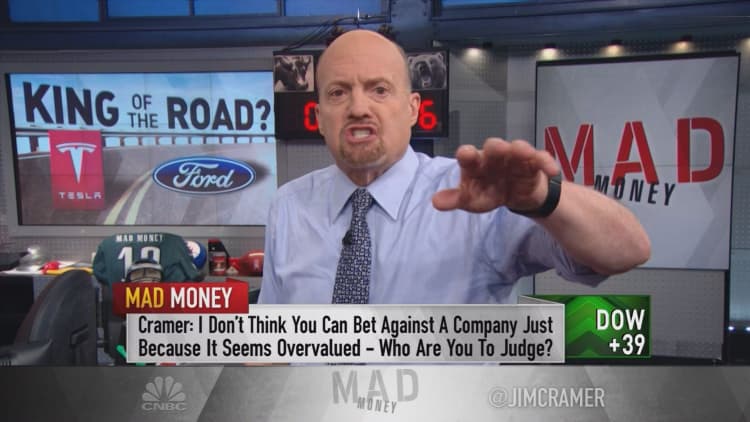

As Wall Street buzzes about automaker Tesla passing rival Ford in market value, Jim Cramer decided to parse the facts and determine who really came out on top.

Valuation has always been a touchy subject on the Street, and Cramer firmly believes it remains in the eye of the beholder, or in the market's case, the buyer.

"Tesla isn't worth more than Ford," the "Mad Money" host said. "It's just that there are institutions who are willing to pay more for Tesla's stock than for Ford's right now, and that's the key issue here."

Cramer looked into Ford's recent performance first. In four years, Ford's market capitalization went down from $60 billion to $45 billion, but its revenues went up, from $146 billion in 2013 to $151 billion in 2016.

Watch the full segment here:

At the same time, Ford's gross profit went down by $2.5 billion, and its earnings slid from $1.90 to $1.74.

"Not only that, but given how weak Ford's sales have been this year ... and how many incentives the automakers have had to offer to sell vehicles, it's entirely possible that we're in what's known as peak auto sales. If that's the case, then 2017 could be a down year for Ford," Cramer said.

That explains why Ford is one of the cheapest stocks in the S&P 500. Cramer explained that with most money managers focused on growth, Ford has ceased to be an attractive pick at any price.

Tesla, on the other hand, has shown immense top-line growth despite repeatedly losing money on its shares over the last four years.

In the same four years, Tesla went from $18 billion in market capitalization to $49 billion thanks to its sales, which grew from $2 billion to $7 billion.

Therefore, a money manager who wouldn't dare touch Ford's stock might drool at Tesla's, even though Ford produced 3.2 million cars in 2016 and Tesla made only 83,000.

"He's not deterred by the losses because he's thinking, 'Hey, judging by those revenues, there's relentless demand for what Tesla makes,'" Cramer said. "As long as Tesla doesn't run out of money, it can keep making cars and charging a fortune for those cars, so eventually, it will make a killing. Emphasis on 'eventually.'"

"Eventually" was what all of Tesla's short-sellers were betting against before the company announced it sold 25,000 cars in the first quarter, setting a high bar for the rest of the year that could outshine last year's sales numbers.

They were not expecting that Tesla would be able to raise a substantial amount of cash in the equity market, or that the automaker would snag a deal with Chinese internet giant TenCent, which bought 5 percent of the company for $1.8 billion.

"Since then, justifiably, the stock's been off to the races because that money and the sheer size of the Chinese investor gives the entrepreneurial CEO Elon Musk plenty of breathing room to reach his goal of producing 500,000 cars a year by the end of 2018," Cramer said.

It's no secret that a stock's value is determined by what investors are willing to cough up for its future earnings and sales.

With the rise of giants like Apple, which has a market capitalization of $759 billion, investors are starting to care more about sales growth and expect earnings growth to follow steadily behind.

"Those are the ones who buy Tesla stock every day and many other growth stocks that to you seem overvalued," Cramer explained.

But Cramer does not advise betting against a company simply because you believe it is overvalued, even though his discipline is telling him to stay out of a stock like Tesla's.

"The bottom line is this: you need to stop being hung up on the valuation of individual stocks," Cramer said. "Right now, Tesla and a bunch of other biotech, social, mobile and cloud stocks are being bid up furiously by these growth hounds. If they're right, they'll get even more money in and they'll keep buying their favorites, no doubt including Tesla."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com