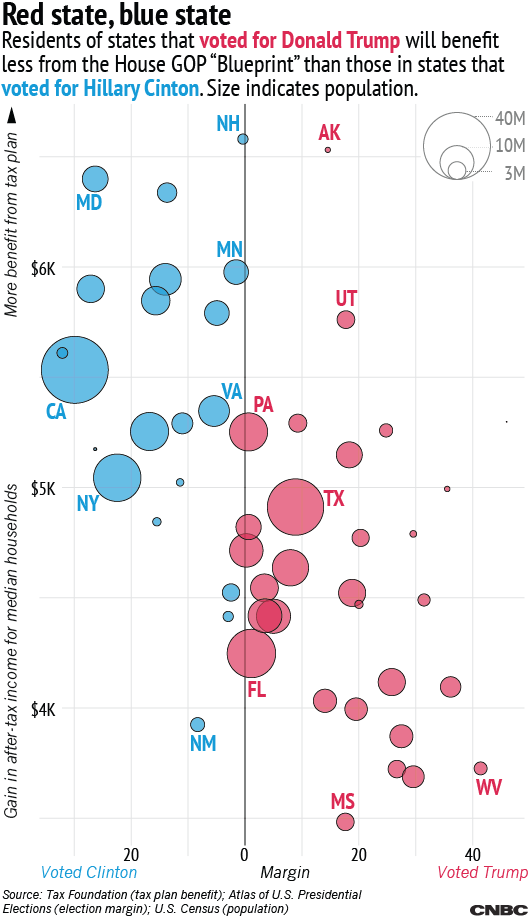

They didn't vote for Donald Trump, but blue states might reap more benefits from Republican tax plans. That's according to a CNBC analysis of fresh estimates from the Tax Foundation, a right-of-center think tank.

The foundation's new analysis adds a state-by-state look to a study done last summer when the House Republicans released their tax reform plan. It estimates the gain in after-tax income for the median household in each state. Overall, the tax reform plan would increase after-tax incomes of median households by 8.7 percent, the study found.

But that figure is different for each state, depending on the economic breakdown of the population. CNBC combined the tax-gain estimates with election returns and population data.