As President Donald Trump's administration nears its 100th day, stocks have kept

The bond market, however, still wants proof.

At some point, one of those two big markets will turn out to be right. So far, there's been no big rush of legislation, just executive orders. But there's still optimism that changes are coming.

"I think that the first 100 days is showing me one thing, and that's that this guy, the current chief executive, he doesn't like to give up, so when the alternative to Obamacare was defeated, he didn't agree with congressional leaders that it was done for this year," said Don Townswick, director of equities strategy at investment management firm Conning. "I think he's pushing to get these parts of his agenda done this year, even if it takes a couple of tries."

But the market won't wait indefinitely.

"He might be learning as he goes along, but if we don't see something by August, ... I think the markets are going to get a little impatient," Townswick said.

The stock market is flying

If Trump were to be measured on stock-market performance alone, he is doing about as well as a president can do. The S&P is up about 6 percent since Trump was inaugurated 97 days ago, and nearly 12 percent since Election Day.

Since World War II, only two first-term presidents saw better gains in the S&P 500 in their first 100 days — John F. Kennedy (a 9 percent gain) and George H.W. Bush (7.7 percent).

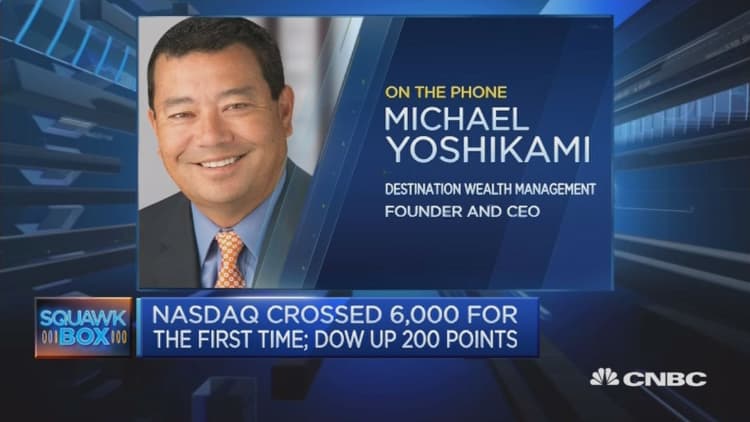

This week, the Nasdaq surged above 6,000 for the first time in history; the Dow closed in again on 21,000, while the S&P 500 is within spitting distance of its all-time high.

"I think everyone's assuming that everything he's been promising is going to come true," said Samuel Stovall, chief investment strategist at CFRA.

The bond market is 'deeply skeptical'

Treasury yields, which move opposite prices, have improved in the recent days, but they're still near the lows of a range they've held since the November election. The benchmark 10-year yield was locked in a range of 2.30 to 2.60 for weeks after the U.S.

"When we first were talking about economic growth picking up, inflation expectations rose. The 10-year yield rose to 2.60, where it's now down to 2.30," after falling below 2.20 percent, said Krishna Memani, CIO of OppenheimerFunds. "The bond market is deeply skeptical."

"In the second half, we basically took off. The fourth quarter of last year and first quarter of this year will probably be the peak of the synchronized economic recovery. That is driving economic growth in emerging markets. That's driving growth in Europe and to some extent; it's driving economic growth in the U.S.," he said.

Memani said there is definitely a divide between the stock and bond markets, but it's something he can make sense of.

"It's not night and day. It's basically we're in the dusk somewhere. It's not the end of the day, and it's not midnight in terms of contrast of different markets," he said. "It's just growth is good. Inflation is not picking up. I think you can justify the current level of the equity market. At one point, the bond market was expecting inflation picking up meaningfully, and it gave up the ghost."

How the health-care fail shifted sentiment

The initial euphoria of the Trump trade really faded in December, but stocks have been moving higher since then as the president's policies complement the uptick in global growth. For the bond market, pessimism began building

"It sapped a lot of the optimism that this was going to be easy and that the Republicans were going to be able to use their clean

But the outlook for a new health bill is unclear, and Trump is expected to reveal a tax plan Wednesday that appears light on new revenue and heavy on tax cuts.

Memani said the market's expectations for a pickup in inflation also has faded, as has the prospect

"You can't build expectations and not deliver. That's what he's doing at the moment. That worked when growth was good, and when growth is not good you don't have any credibility," said Memani. He said a tax plan that adds to the deficit would stimulate growth, and that could help replace some lost tax revenue.

"He can have policies that can improve the regulatory environment and cut tax rates, but the likelihood that it will jump-start the economy and get the growth rate to 3 percent, ... the deficit has to widen. A tax plan where everything is paid for will not do it. ... The trend [growth] rate is 2 percent, and to jump-start that, you need some new driver," Memani said.