OPEC is widely expected to extend production cuts that initially boosted oil futures above $50, but prices just keep falling.

That raises concerns that oil prices could struggle to return to their 2017 highs in the mid and upper $50s even if the Organization of the Petroleum Exporting Countries carries over the output reductions through the second half 2017 when it meets in three weeks.

That announcement could boost prices by $2 or $3 a barrel, said John Kilduff, founding partner at energy hedge fund Again Capital.

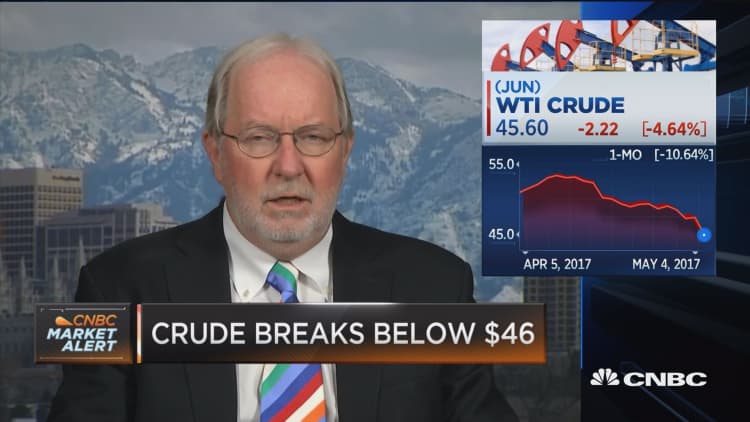

But that would leave a lot of ground to cover. Thursday's sell-off sent U.S. crude prices below $46 a barrel, while Brent futures slumped to under $49. Those levels have not seen since Nov. 30, when OPEC agreed to slash output by 1.2 million barrels a day in a bid to shrink huge stockpiles around the world.

U.S. West Texas Intermediate crude oil 3-day performance

Early losses fueled by technical selling accelerated after OPEC sources told Reuters that the cartel was unlikely to make cuts deeper. Some believe that is necessary because U.S. drillers have taken advantage of this year's higher prices to increase production, while OPEC members Libya and Nigeria, both exempt from the deal, have raised output more than anticipated.

Despite historically high compliance to production quotas, the world's storage tanks are still brimming.

This week, a Reuters survey indicated that OPEC's April compliance remained above 90 percent, but had slipped from the previous month. That shows compliance "is as good as it's going to get for them, and it's still not working," said Kilduff.

"People keep forecasting that global inventories are going to come down, but so far, they haven't for the most part," he said.

U.S. crude stockpiles have fallen in the last four weeks, but remain near an all-time high set in March. Meanwhile, inventories in developed countries were 336 million barrels above the five-year average in February, the International Energy Agency said in its latest report.

"I think there's a consensus view that the glut is slimming down, but ... it is at a painstakingly slow pace that makes a glacier look like a rocket," said Tom Kloza, global head of energy analysis at Oil Price Information Service.

Kloza expects stockpiles to draw more quickly this quarter and next as the summer driving season gets under way, but refiners risk creating a glut of refined fuels like diesel and gasoline.

That is becoming a growing concern for analysts because recent government data has shown weak demand for gasoline despite robust activity at the refineries that churn out fuel.

"The problem is that gasoline demand in the U.S. certainly appears to be off compared to last year, and if we don't pull gasoline inventories during the driving season, what it means is we're just turning the crude oil surplus into a petroleum products surplus," said Andy Lipow, president of Lipow Oil Associates.

Traders looking through a 'bearish lens'

Helima Croft, global head of commodity strategy at RBC Capital Markets, cautioned that the market may be reading too much into recent headlines.

She noted that the implied drop in OPEC compliance was driven by a production increase in Angola and a smaller-than-expected output drop from the United Arab Emirates, while overall adherence, particularly among large exporters, remains high.

As for worries about rising output in Libya, the country has experienced stops and starts in its oil fields throughout a long civil conflict, she said. It also remains to be seen whether militias will support a nascent power-sharing deal between the nation's chief adversaries.

Traders are "looking for any sign that OPEC will capitulate," she said. "Everything is read through a bearish lens."