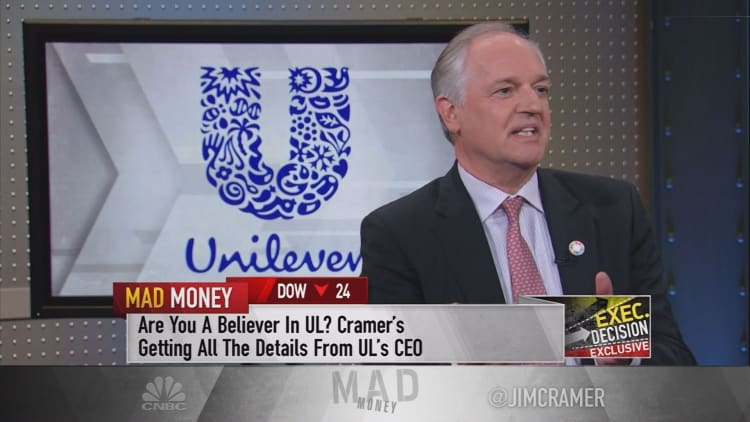

After Kraft Heinz's failed attempt to acquire Unilever and Warren Buffett's defense of the offer, Unilever CEO Paul Polman offered a response to the legendary investor's moves.

"In the end, our strategy ... in investing is Warren's strategy. And my returns have been higher in the last eight years than Warren's returns. So I think it's better if he leaves us with what we know how to do well," Polman told "Mad Money" host Jim Cramer on Thursday.

Polman said Unilever denied the offer because of the difference in the companies' models. Unilever's tells a growth story, but the CEO said he was not as convinced by Kraft Heinz's.

"We've only accelerated that in the last eight years, so there is nothing wrong. Double the market growth, enormous returns," he said. "And here, you see two conflicting models: us, a long term compounding growth model, and someone here that really hasn't proven that they can grow."

Watch the full segment here:

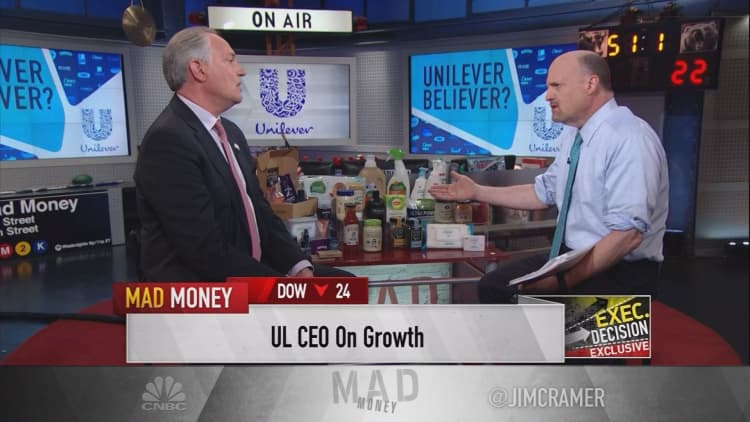

Merger drama aside, Unilever is performing on its own. Polman said that since it was founded in the 19th century, the company has always focused entirely on its consumers and stakeholders, a strategy he said was to the benefit of its shareholders.

"I come from a part of the Netherlands where we keep our heads down and deliver, and delivered we have done. Our top line growth over the last eight years has been 5 percent a year on average in a market that's only growing half. Our shareholder return has been over 200 percent," Polman said.

And Unilever has been aggressively chasing the millennial market. The CEO stressed having a portfolio that is "future-fit," filled with brands that younger generations use and enjoy.

"What you see is consumer-direct [trends], so we bought Dollar Shave Club. Millennials are Ben & Jerry consumers, Seven Generation consumers. We just bought a very cool brand, Sir Kensington, which is in condiments," the CEO said.

And in a changing market, Polman said he was happy to have children who keep him and his company up to speed.

"The market is changing very fast, Jim, and consumers are changing very fast," he told Cramer. "And you have two millennial kids and they are totally different from what we were, and normally, the saying would go, 'Wait until they start working and pay tax and they turn out like us.' It's not the case anymore and you know it."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com