The tech sector is on fire, with semiconductor stocks seeing major gains almost every day, but Jim Cramer noticed that one name has been lagging behind the rest: Qualcomm.

"Here's a company that's in the middle of acquiring longtime Cramer-fave NXP Semiconductors, a terrific play on the internet of things and the connected car that my charitable trust owns, but Qualcomm's stock has just been a total dog," the "Mad Money" host said.

A key player in the telecommunications space that provides chips and other equipment to various smartphone makers, Qualcomm has seen its stock go down 15 percent since the start of 2017, while the rest of the Nasdaq 100 rallied 17 percent.

To figure out whether Qualcomm's stock can break out of its rut, Cramer turned to the charts of technician Tim Collins, his colleague at RealMoney.com with a strong record on predicting technology stocks' moves so far this year.

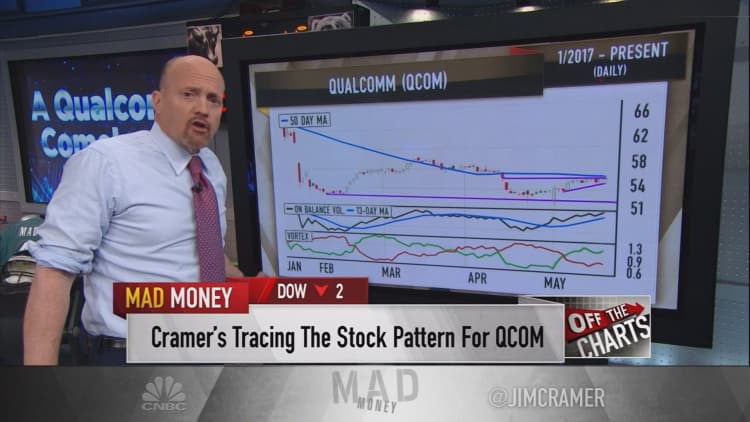

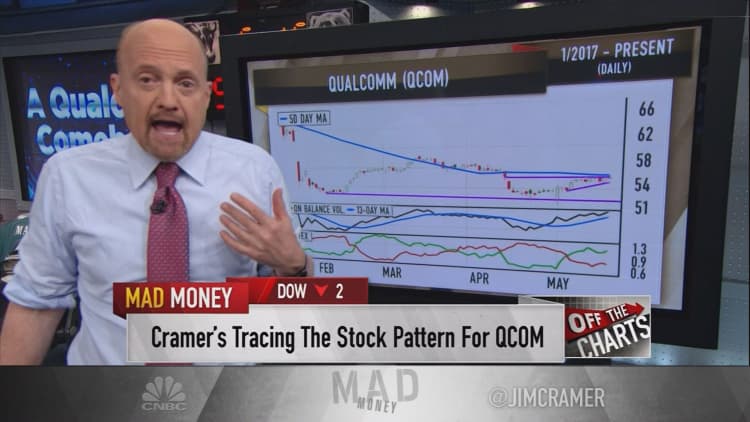

First, Cramer looked at Qualcomm's daily chart. After taking a hit in January that sent the stock from the mid-$60s to the low $50s, it has maintained a range of $52 to $59, unable to bridge the gap to its January highs.

"But Collins believes that Qualcomm could soon see a definitive change in its trajectory," Cramer said. "The reason? First of all, the stock's 50-day moving average, and that's the blue line, has flattened out lately, to the point where it's running just above the top of an ascending triangle pattern."

This moving average is important because Collins thinks that it could be the catalyst for Qualcomm's stock to run higher if the stock can break above that average.

As Qualcomm's stock is 10 cents away from the 50-day moving average, that goal seems achievable. If it closes above the average, a rally could be in store.

However, Cramer acknowledged that this pattern was already tested once before. In March, Qualcomm crossed above its 50-day moving average only to come back down a few weeks later.

What makes this time different is the slope of the average. In March, it wasn't finished heading downward, but now it has flattened out.

"That means if Qualcomm's stock pushes higher, it will run up right alongside this moving average," Cramer explained.

And two other key indicators, the On Balance Volume line and the Vortex Indicator, made bullish crossovers in the last several weeks, signs that the stock may be on the verge of an upward tear.

"Put it all together, and Collins thinks this $55 stock is very close to a big move, and it could very quickly climb to $59," Cramer said.

The stock's weekly chart supports Collins' predictions as well. The full stochastic oscillator, which measures when stocks are overbought or oversold, shows that Qualcomm is still far from being overbought.

Or take the Chaikin oscillator, which tracks the number of people buying and selling a given stock. That has made a bullish crossover, another good sign.

"Collins expects both of these oscillators to cross above their midpoints in the near future, which will serve as a trigger telling all the other chart watchers out there that it is time to buy the stock of Qualcomm," Cramer said. "If we get these triggers, then Qualcomm, Collins believes, can climb anywhere from $59 to $62 within the next three to six months."

So while Qualcomm's success will, from a technical standpoint, ultimately hinge on whether the stock can break out over its 50-day moving average and its $55 level, Cramer has faith in Collins' forecast.

"The charts, as interpreted by Tim Collins, suggest that Qualcomm could soon be ready to play catch-up, and given all the diversification away from cellphones that the company's getting with that pending acquisition of NXP Semiconductors I like so much, it wouldn't be at all surprising if Qualcomm can start levitating with the rest of the group," the "Mad Money" host said.

Watch the full segment here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com