Bitcoin's meteoric year is making owners of the digital currency rich while raising concerns that things could be getting out of hand.

One investing vehicle is standing out — the Bitcoin Investment Trust (GBTC), which is designed to track the asset price but actually is trading at a significant premium compared with the underlying holdings.

Specifically, bitcoin's price had surged a gaudy 170 percent in 2017 as of Wednesday's close. The trust, though, had jumped about 336 percent, raising alarms that investors trying to capitalize on the surge are taking on too much risk.

The big problem is net asset value, or the price of a share compared with the underlying holdings.

GBTC holds 174,174 bitcoins, according to the most recent regulatory filing. Multiplying that by the current price of bitcoin and dividing that by the amount of shares outstanding suggests a price in the $250 range. Instead, the price closed Wednesday at $528.

"For investors buying into the fund, such large premiums are a disaster waiting to happen," Sumit Roy wrote in an analysis for ETF.com.

Almost on cue, the trust's price was tumbling Thursday, down more than 8 percent in afternoon trading even as bitcoin rose about 1.5 percent.

A spokesman for the trust's manager, Grayscale, said the firm is prohibited by law from commenting.

GBTC resembles an exchange-traded fund in that it is passively managed and has been seeking to replicate bitcoin's movement. It's been around since May 2015 and is not listed on a major exchange, trading instead in the "pink sheets" or the over-the-counter market. The trust offers investors a rare chance to invest in digital currency without actually have to buy bitcoins.

However, the failure to replicate the price the way, say, the SPDR Gold Shares ETF accurately tracks the metal, is a problem that became especially acute earlier this year. Grayscale sought in January to make the trust a full-fledged ETF and was restricted from creating new shares.

"Why would anyone pay a premium for this? Clearly the product does not function incredibly well," said Spencer Bogart, head of research at Blockchain Capital and a former sell-side analyst who covered GBTC when it launched.

Bogart believes the answer to his question is largely because there are few if any other alternatives to investing in bitcoin without having to go through the process of actually buying the digital currency.

Twin brothers Cameron and Tyler Winklevoss have been unsuccessful thus far in bringing a bitcoin ETF to market. Earlier this year, the Securities and Exchange Commission rejected an application for a fund that would trade under the ticker COIN. However, the commission has decided to review that decision.

"A lot of investment managers have a mandate that they must be invested in registered securities. Spot bitcoin is not a registered security," Bogart said. "Really, it's the best that we have available. This put a traditional wrapper around an otherwise esoteric asset. It was something people could touch. They really wanted exposure and this was the only way to do it."

If either the GBTC effort or the Winklevoss filing want to be successful, they likely will have to demonstrate a better ability to track bitcoin's price. ETFs for the most part successfully use a variety of techniques to make sure that the price represents the value of the underlying securities, whether it's a basic stock index, bond class or currency.

GBTC is billed as an open-end investment trust, meaning it can sell unlimited shares, unlike a closed-end fund. However, the fund is no longer issuing new shares or allowing redemptions since it petitioned to convert the fund into an ETF so it can resume normal operations.

Roy said the problems with the trust actually might help the Winklevoss case.

"The SEC can either help investors by allowing a regulated ETF that trades close to NAV come to market, or stand in the way and see those same investors hurt when they buy bitcoin directly from untested exchanges or through the flawed GBTC," he wrote.

As for investors looking to find their way into the bitcoin universe, they'll have to understand that buying the currency is risky but the trust looks even riskier.

"There's clearly a risk. Somebody could be right about the underlying move of bitcoin but still lose money," Bogart added. "To what extent do you value the features (of the trust)? It's really an individual question to answer."

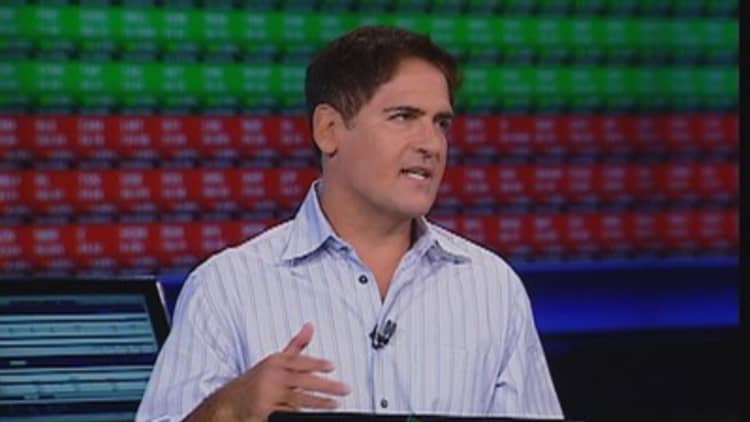

WATCH: Mark Cuban explains why he thinks bitcoin is a bubble.