Warren Buffett's top lieutenant, Charlie Munger, told a small group of investors that the simple strategy of buying only service company stocks made former Vice President Al Gore very wealthy.

"Al Gore has come into you fellas business. ... He has made $3 or $400 million in your business. And he's not very smart," Munger said at the Daily Journal annual meeting on Feb. 15. "He had one obsessive idea that global warming was a terrible thing. … So his idea when he went into investment counseling is he was not going to put any CO2 in the air."

Though the comments were made more than four months ago, they went largely unnoticed and have not been widely reported on elsewhere.

Hedge fund manager Whitney Tilson in one of his email newsletters pointed to the YouTube videos of Munger's informal question-and-answer session held after the Journal meeting, and other investors have confirmed the subject matter of the talk.

Munger is one of the most celebrated investors in the world and was an essential partner in Buffett's success. Before becoming vice chairman of Berkshire Hathaway, the billionaire had quite the track record himself. From 1962 to 1975 Munger's investment partnership generated 20 percent annual returns versus the 's 5 percent.

He also shared more details on how Gore became successful in the money management business:

"So he found some partner to go into investment counseling with and says we're not going to have any (carbon dioxide). But this partner is a value investor and a good one. So what they did is, is Gore hired staff to find people who didn't put CO2 in the air. Of course that put him into services. Microsoft and all these service companies were just ideally located. And this value investor picked the best service companies. So all of a sudden the clients are making hundreds of millions of dollars and they are paying part of it to Al Gore. Al Gore has hundreds of millions dollars in your profession. And he's an idiot. It's an interesting story. And a true one."

Gore is co-founder and chairman of Generation Investment Management. The firm has more than $15 billion of assets under management and focuses on investing in low-carbon generating sustainable companies, according to its website.

One of its main funds beat the S&P 500's return by more than 6 percentage points per year during the last the five years, according to a March 2017 Barron's article.

Munger said the strategy of buying only service companies helps investors avoid capital-intensive firms, which have weaker business models and are less profitable.

"Inventories, receivables are all kinds of horrible things in business. If you just buy service companies, you can avoid them. And it's amazing how it has worked for this guy that does [leveraged buyouts] just the way it worked for Al Gore," he added.

Berkshire Hathaway did not immediately respond to a request for comment. Generation Investment Management declined to comment.

The YouTube video with Munger's service investing strategy comments had less than 3,000 views as of Friday morning.

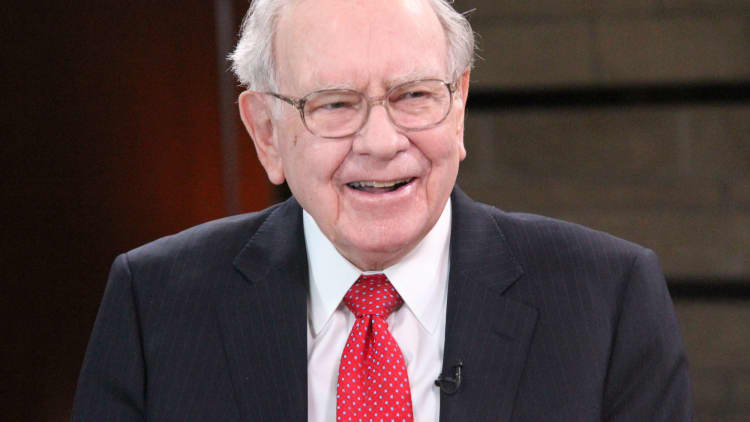

WATCH: How Warren Buffett makes long-term investments