Warren Buffett's Berkshire Hathaway eyed real estate investment trust Store Capital for three years before investing in the company.

"The investment was the result of Berkshire Hathaway contacting us. They became aware of STORE Capital in 2014 and have been following our progress closely since then," Store Capital CEO Christopher Volk wrote in a statement to CNBC, giving outsiders a rare look behind the scenes of how Berkshire does business.

"They became deeply familiar with the company, our strategy, business model, experienced management team and disclosure. They were prepared to take advantage of an attractive buying opportunity in the market and they did so. We are delighted [to] welcome Berkshire Hathaway as a shareholder," he added.

Store Capital announced on Monday that Berkshire invested $377 million in the company, which represents a 9.8 percent stake in the real estate investment trust.

The company issued 18.6 million shares of Store Capital in a private placement to a subsidiary of Berkshire Hathaway, National Indemnity Co., at $20.25 per share.

Berkshire Hathaway's investment makes the company the third largest holder in Store Capital, after Vanguard Group and Fidelity Management & Research, according to FactSet.

Store Capital has investments in over 1,750 properties in 48 states, according to the company. AMC Entertainment, Applebee's and Ashley Furniture are among its 10 biggest customers, according to an investor presentation.

Store describes itself as the leader in "Single Tenant Operational Real Estate" and says it is "dedicated to real estate net-lease profit-center property investments."

Berkshire Hathaway did not immediately respond to a request for comment. It is not clear who at the company is directly responsible for the Store Capital investment.

Store Capital shares rose more than 10 percent midday Monday after the news.

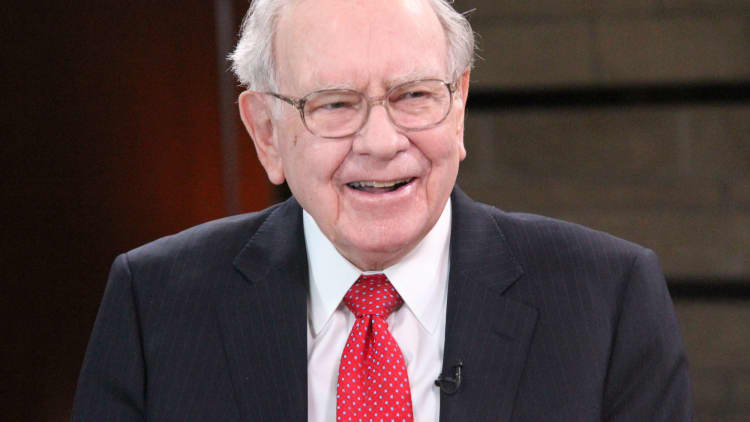

WATCH: How Warren Buffett makes long-term investments