When Jim Cramer noticed that the market stayed high on Wednesday despite massive declines in two of its most important sectors, he had to investigate.

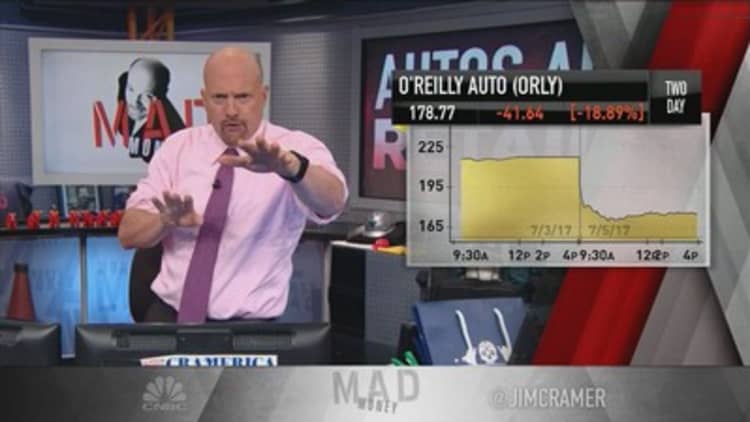

The "Mad Money" host watched swaths of the auto sector topple after auto parts retailer O'Reilly Automotive reported a stark earnings miss, with declines stretching as far as retailers Home Depot and Lowe's, both of which have auto components to their sales.

"For the longest time, this kind of concentrated selling could bring the entire market down — makes sense given that autos and retail are so heavily linked to the overall economy," Cramer said.

But on Wednesday, dramatic declines in both areas did not seem to drag the market down with them. Why?

"Because there have been some fundamental changes in the U.S. economy that are not being acknowledged by many people on air, on web, whatever, and they're allowing the market to blossom without the traditional spurs of retail sales or autos," the "Mad Money" host said.

Watch the full segment here:

More specifically, Cramer named 10 areas contributing to the market's overall strength based on the 52-week high list he follows almost religiously: travel and leisure, health care, capital goods, oil and gas derivatives, the stay-at-home economy, defense, aerospace, housing, e-commerce and the banks.

First, Cramer sees travel and leisure's boom as a direct result of millennials' disinterest in material goods. They are choosing to spend their money on seeing and doing, in part due to the rise of the "selfie generation," and in part because of a genuine desire to see the world, he said.

"Whatever, travel and leisure stocks, everything from hotels and time shares to airlines and cruises, live on the new-high list, and with good reasons: they all seem to have endless runs of better-than-expected earnings — remember, that's what drives stocks — and, crucially, these industries employ a huge number of people," Cramer explained.

Second, health care bills may be burdensome, but Cramer insists that the country's health-care-related woes — including the holdup of the Republican health care bill in the Senate — have been blessings to insurance providers, medical device makers, hospitals, biotechnology companies and pharmaceutical giants.

Third, capital goods companies have been seeing healthy earnings boosts, which Cramer attributed to an improving global economy.

"Many of our capital goods businesses realized years ago that they had to diversify away from the United States and they spread their wings to Europe and Asia and all sorts of emerging markets," he said. "Those moves turned out to be poorly timed, sub-optimal, at least until this year. With the rest of the world now in recovery mode, heavy equipment makers are experiencing what I am regarding as a nirvana moment."

Fourth, while the oil and gas space is struggling, companies that use natural resources to make things like plastic have grown "seemingly unstoppable" as they enjoy cheaper energy sources, Cramer said.

Fifth, the stay-at-home economy may seem like a death sentence for brick-and-mortar retailers, but it is a boon to home entertainment giants like Netflix and video game makers like Activision Blizzard.

"The point is, the money's actually going somewhere, just not where it used to go," the "Mad Money" host said.

Sixth, defense is top of mind for many given North Korea's recent missile test, so giants like Lockheed Martin and General Dynamics are also seeing healthy earnings streams.

Seventh, aerospace orders are up, ushering in a bull market for the sector that only serves to prop up names like Boeing.

"Eighth, we know housing is an industry that punches above its weight. It accounts for only about 10 percent of consumer spending, but the demand for housing is off the charts versus the supply, which explains why the homebuilders endlessly hit the 52-week high list even though the overall housing start numbers aren't that strong and rates are going higher," Cramer said.

Ninth, with Amazon at the center of Wall Street buzz given the announcement of its bid for Whole Foods, e-commerce is shaping up to be the driver for an array of related industries, from logistics to shipping to data centers, the "Mad Money" host said.

Finally, the banks are a new but formidable addition to the new-high list given the Federal Reserve's commitment to its agenda of raising interest rates despite low inflation.

"So, here's the bottom line: it's true, autos and traditional retail may be weak. But these 10 other sectors can justify an awful lot of strength, certainly enough to make it possible for the stock market to plow higher, even without the usual suspects helping us along," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com