For Jim Cramer, Friday's unexpectedly strong jobs report numbers validated the strength of the high-flying stock market.

"Employment growth means money to buy a car or to buy a house, hence why the housing stocks roared today [to] new highs. Do I really need to explain how hiring helps the banks and techs and the industrials?" the "Mad Money" host said. "It also shows us which industries have the best growth. ... Right now it's health care, and that's a signal that these stocks, which have held up incredibly well, can keep rising."

Certainly, employment growth is not the only number investors should watch when it comes to predicting the market's next move.

"Of course, as important as the non-farm payroll report is, at the end of the day, what really matters for individual stocks are the earnings, and we kick off a brand new earnings season on Tuesday," Cramer said.

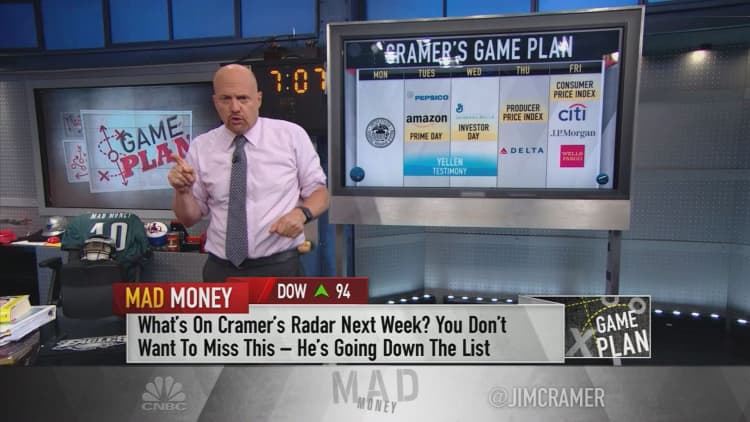

With that in mind, here are the stocks and events on Cramer's radar next week:

Monday: Federal Reserve speaker

John Williams, the president and CEO of the San Francisco Federal Reserve, will speak on Monday, and Cramer is curious to see if Friday's strong employment number will be translated in to action.

More specifically, the "Mad Money" host wants to see if Williams, a non-voting Federal Open Market Committee member who previously talked about having three interest rate hikes this year, will change his view and advocate for four hikes.

"It's incredibly important because lately, this market's been led in part by the financials, and an important Fed head arguing for four hikes would be music to their ears, especially given that we are going to get a lot of bank earnings at the end of the week," Cramer said.

Tuesday: PepsiCo, Amazon Prime Day, Fed Chair Janet Yellen

PepsiCo: This Cramer-fave consumer packaged good company will deliver the first major earnings report of the week.

The "Mad Money" host expects good numbers from the Indra Nooyi-run PepsiCo because it is well managed and deals in one of the strongest parts of the supermarket: snacks.

"If PepsiCo gets hit after it reports, you should be ready to buy," Cramer said.

Amazon Prime Day: On a day that lives in retail infamy, Amazon will offer its Prime shoppers massive deals in a show of force for the e-commerce giant.

"I bet the numbers show a 20 percent increase over last year's Prime Day, which I expect to cause a boatload of retail analysts to come out of the woodwork and downgrade any retailer that is still standing that they haven't downgraded yet," Cramer said, adding that only then might the market find a bottom for some of the hardest hit brick-and-mortar names.

Janet Yellen: The chair of the Federal Reserve will begin a two-day testimony about the state of the U.S. economy on Capitol Hill in Washington D.C.

"I expect both days will be riveting ... and I'm hoping she'll stay on message: more rate hikes needed in a gradual attempt to get us back to normal. I agree completely. Alas, Yellen has too much self-control to ever really snap at any of the bozo politicians who ask her inane questions, but maybe she'll surprise us," Cramer said.

Wednesday: General Mills Meeting

An analyst meeting at consumer foods giant General Mills will give its new CEO, Jeff Harmening, a chance to outline his strategy for the company.

While Cramer is not sure what Harmening might suggest that former CEO and current chairman Ken Powell had not already tried, he hopes growth is in the cards.

Thursday: Economic Statistics, Delta Air Lines

Statistics: The Producer Price Index, which measures the average changes in selling prices that domestic producers get for the products they manufacture, will release its numbers for June.

Paired with Friday's Consumer Price Index numbers, which measure how much consumers pay on average for goods and services, the indices should be telling of where U.S. inflation stands.

"Even if these numbers are as tame as I expect them to be, I think the Fed has enough latitude for two rate hikes this year," Cramer said. "In my view, they've still got a long way to go before higher interest rates represent any kind of meaningful risk for this economy."

Delta: After hitting an all-time high this Friday, Cramer wonders whether the rally is deserved. Thursday's earnings report from the airline may shed light on its success or lack thereof.

"You know I think the airlines are still undervalued. However, I do wish that Delta's stock would take a break from its take-off ahead of the quarter," the "Mad Money" host said.

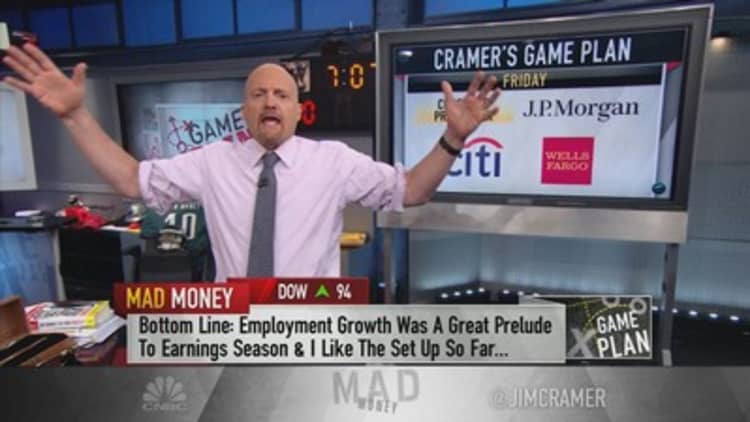

Friday: Citigroup, JPMorgan Chase, Wells Fargo

Citigroup: Cramer thinks this bank, under the leadership of CEO Michael Corbat, was the ultimate winner of the Fed's recent stress and capital tests.

"I think its stock dramatically undervalues the overall enterprise ," Cramer said, looking ahead to its Friday earnings report. "It's a sterling example of what I think is cheap even when the broader market may spook people."

JPMorgan: A bustling, $333 billion business with over 240,000 employees worldwide, JPMorgan seems to be heading for a strong earnings delivery on Friday.

"The stock sells at just 14 times earnings despite its terrific growth, fortress-like balance sheet, [and] good management. All I can say is I hope that when JPMorgan reports, the stock comes down so on Friday evening's show next week I can say to buy it and reiterate Monday morning," Cramer said.

Wells Fargo: "Problematic," Cramer said of the bank, which will report earnings along with its competitors on Friday.

The "Mad Money" host predicted that because of recent scandals, Wells Fargo might hesitate to show meaningful growth in its report for fear of regulators thinking it is using illegal tactics again.

"Here's the bottom line: we get a fabulous prelude to earnings season today when the non-farm payroll number came out. I like the setup, especially because there are so many faux bulls ... out there and a colossal number of bears in bulls' clothing," the "Mad Money" host said. "My take? It pays to be prepared for the downside, but understand that a solid employment number indicates that earnings could be better than expected, which means this market may have more room to run."

Watch the full segment here:

Disclosure: Cramer's charitable trust owns shares of PepsiCo, Citigroup and Wells Fargo.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com