OPEC faces a wealth of challenges as it seeks to keep its deal to limit oil production alive for eight more months, analysts said Monday as oil ministers met in St. Petersburg to discuss the accord.

While the producers have done a better job of sticking to the deal than in the past, the accord may come under further stress as the months grind on, analysts said.

"Various producers will try to comply, but I think compliance will slip versus what has happened in the first half of this year," said Victor Shum, head of IHS Markit's oil market and downstream energy practice in Asia.

"It seems like OPEC really faces a mission impossible at this time, which is to try to tighten oil markets and to sustain oil prices," he told CNBC Asia on Monday.

OPEC was generally upbeat about the deal but acknowledged in a statement that some members had not entirely done their part. The cartel said it had "serious discussions" with those countries.

The 14-member cartel and other oil exporting nations including Russia are trying to clear a global glut of crude oil by keeping 1.8 million barrels a day off the market through March. On Monday, the ministers did not discuss making deeper cuts, which some analysts have said are necessary, but OPEC members took other measures to shore up the deal.

Oil prices rose on Monday after top exporter Saudi Arabia vowed to limit its exports to 6.6 million barrels a day in August, about 1 million barrels below last year's shipments. Nigeria, one of the two OPEC members exempt from the cuts, agreed to cap output once its production stabilizes at 1.8 million barrels a day, OPEC said.

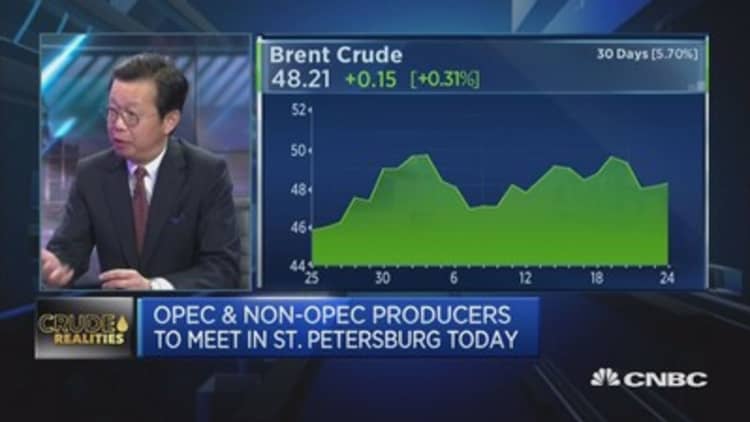

While the deal initially boosted oil prices above $50 a barrel, they have since slumped below that key psychological level. Surging output from U.S. shale fields, a rapid recovery in Libyan and Nigerian production and robust crude exports have made it harder for OPEC to shrink global stockpiles.

Last week, OPEC-member Ecuador put another crack in the deal, saying it would start raising output to plug a budget deficit.

To be sure, Ecuador's output is a "drop in the bucket," said Greg Priddy, director of global energy and natural resources at Eurasia Group. He, too, expects more members to start cheating, but said that is to be expected the longer these deals last.

He said OPEC is unlikely to agree to deeper output cuts. While that would likely boost oil prices, it would also lead to another surge in U.S. oil output.

"They realize that if they tried to jump start prices they would get short-term benefit from increasing prices over the next six months or so, but they would get a real head of steam behind U.S. production growth heading into next year, more loss of market share and eventually prices coming down toward the same equilibrium," he told CNBC's "Squawk Box."

That would make it even harder to unwind the production deal next year, Priddy said.

In the meantime, it might be difficult to bring Libya and Nigeria, the two members exempt from quotas, into the fold, said Helima Croft, global head of commodity strategy at RBC Capital Markets. While output in both countries has surged lately, they have weathered periods of prolonged internal conflict that cratered their production in recent years.

"If you're Libya and Nigeria, and you've been suffering through chaotic political and security problems, you don't want to cut your production. You want every last barrel," Croft told CNBC's "Worldwide Exchange."

The question then is whether Saudi Arabia will pick up the slack if OPEC cannot get Libya and Nigeria on board, Croft said.

The Saudis are preparing to take public part of their state oil giant Saudi Aramco next year, and higher oil prices would make the company look more valuable. In light of that, the kingdom may be forced to step up and do even more, Croft said.