If it's possible for a Federal Reserve meeting to be routine, the July meeting could be just that — with one exception.

Fed watchers are not expecting the central bank to take any policy action. It is not expected to raise interest rates until the end of the year, and it is not expected to make moves yet to shrink its $4.5 trillion balance sheet, other than possibly suggest it could make an announcement soon. But they are hanging on how the Fed characterizes one word in its 2 p.m. statement Wednesday—and that is inflation.

"If the Fed does adjust the inflation language, as we suggest, it just would acknowledge further softness in inflation...That's a little bit dovish," said Mark Cabana, head of U.S. short rate strategy at Bank of America Merrill Lynch. Cabana said BofA expects core PCE inflation to be 1.5 percent at year end.

But while many expect a tweak in the language to acknowledge weaker inflation, some do not and that makes the inflation discussion a point of tension in the market. Inflation has been stubbornly low during the entire economic recovery, but this year it got softer and that has been a concern to Fed officials, who have targeted a 2 percent rate.

The Fed's preferred inflation measure is PCE inflation, and that was up 1.4 percent year-over-year in May, declining since a peak of 2.1 percent in February. How much of that concern is put into the Fed's statement could have a significant impact on markets, and the outlook for interest rates.

Fed Chair Janet Yellen this month already of what the Fed might do with interest rates this year, when she sounded more concerned about low inflation during her semi-annual testimony before Congress. Her . It also reduced already low expectations for an interest rate hike in December.

In the weeks before her testimony, Fed officials had been describing the dip in inflation as "transitory." But when Yellen diverged slightly in testimony, the as more dire. She said the lower readings are partly the result "of a few unusual reductions in certain categories" and while she previously pointed to factors such as the steep drop in wireless telephone charges this year as temporary phenomena, the market viewed that comment as something more mysterious.

Other categories, such as health care, automobile prices, and apparel have all been softer. The widely watched consumer price index was weaker than expected four months in a row, and the June reading, released the week of Yellen's testimony, . From a year earlier, the CPI was up 1.6 percent, the fourth month of surprising weakness. Excluding food and energy, the core prices rose 0.1 percent, compared with expectations for 0.2 percent.

"I think the market is much more worried about the inflation story and was buying the Fed's initial narrative that it was transitory. The chairwoman has at least acknowledged in passing that there might be something more afoot...I think that's what the market wants clarity on," said Ian Lyngen, head of U.S. rate strategy at BMO. "Having mentioned a fair amount about inflation already, they could leave the statement unchanged and an unchanged statement in this context would be interpreted as more hawkish."

The Federal Open Market Committee, in its June 14 statement, said it expected inflation on a 12 month basis to remain below 2 percent in the near term but to stabilize around 2 percent over the medium term. "Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely," it said.

In the , inflation expectations have fallen about 20 basis points for the next couple of years compared with the June survey, with the consumer price index forecast to rise 1.9 percent this year and 2.2 percent in 2019.

Lyngen said the Fed does not want to unsettle the markets, with either a more hawkish or dovish sentiment on inflation, ahead of an expected September announcement on its balance sheet.

"I think the Fed wants to leave the door wide open for a September taper and in so doing, they'll want to make sure the market doesn't further increase its sensitivity to the inflation numbers," he said.

The Fed has said it would begin to shrink its $4.5 trillion balance sheet by slowing the monthly purchases it makes to replace the Treasury and mortgage securities on its balance sheet, as they mature. The Fed has detailed how it will begin with a total $10 billion a month and raise it after three months, gradually increasing the tapering back of purchases. The balance sheet was built up with Fed asset purchases, or quantitative easing, during and after the Great Recession.

The Fed has primed the market to expect it to discuss the upcoming wind down of its balance sheet, but views are varied on how much it will say.

In June, the Federal Open Market Committee said it "expects to begin implementing a balance sheet normalization program this year, provided that the economy evolves broadly as anticipated." Some Fed watchers do not expect much change in the statement, but there was some speculation the Fed could be more specific about the timing.

"People are expecting it to be a sleeper announcement. Maybe [the Fed] wakes people up a little bit by saying, 'we are telling you in advance, we're going to start the wind down in September," said Chris Rupkey, chief financial economist at MUFG Union Bank.

Cabana said the Fed could give more details on the balance sheet normalization process, and the Fed could point to its September meeting or say it will take action soon. He said one risk, though small, is that it makes an announcement to move right away on the balance sheet.

"We assign pretty low odds to that. It seems the market is not anticipating that and it would likely be a surprise to the market, and a hawkish surprise at that," he said.

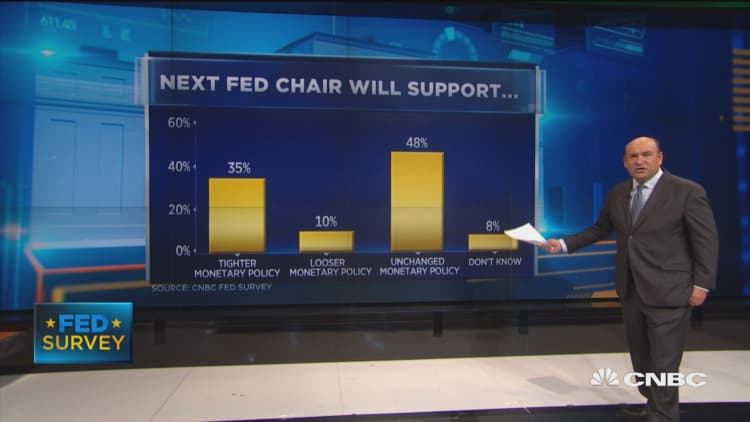

WATCH: Next Fed chair in air till fall