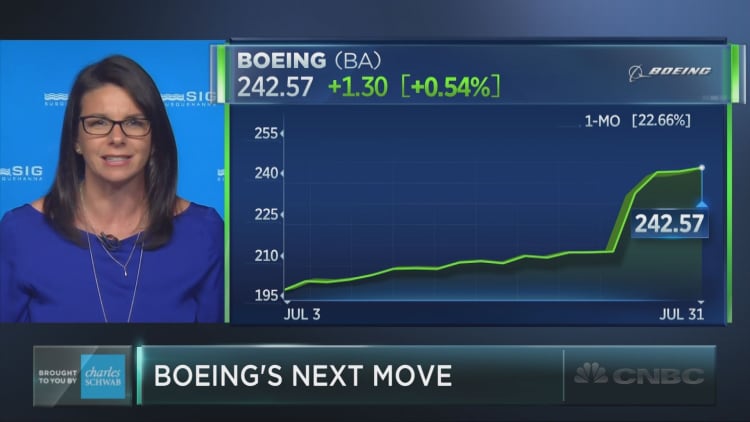

Following a surge on its quarterly earnings, shares of aircraft manufacturer Boeing just logged a July gain of nearly 23 percent — its best monthly performance since October 1982. Strategists see the potential for further upside for the stock following its record month.

"In general, we've been bullish on the defense industry for a number of years now, and Boeing, in particular, has ranked high in our momentum work since March," said Ari Wald, head of technical analysis at Oppenheimer.

To be sure, the stock has run up a lot in a short period of time, which leads Wald to suspect that it is overbought in the near term. This indicates that now is not the time to add to a position, though at the same time, Wald noted Monday on CNBC's "Trading Nation," "the rules to a momentum strategy are to let your winners run. So we wouldn't be a seller here, either."

Boeing shares have now gained nearly 55 percent year to date, and 81 percent over the last year. The company in its earnings report last week raised its full-year forecasts and said it would cut its full-year capital expenditure by $300 million.

The stock hit an all-time high, and in its seven-day winning streak ending Monday contributed to most of the Dow Jones industrial average's gains. In Monday trading, the stock propelled the Dow to a record close.

Wald said Monday the levels to watch on the now $241 stock are $235, followed by $215, which have proved to be levels of support for the stock. Overall, he said, the stock will likely trade "sideways" while the moving averages catch up to the price. Indeed, the stock is now trading 37 percent above its 200-day moving average and 19 percent above its 50-day moving average, which may give investors pause.

From a trading perspective, the sentiment is certainly more in the bullish camp, said Stacey Gilbert, head of derivative strategy at Susquehanna.

Positioning in the options market, which may give some insight into how volatile a stock will prove to be over a period of time, doesn't look particularly extreme one way or the other, Gilbert said.