President Donald Trump today offered Americans an appealing description of the tax reform he wants – but none of the details.

There are good reasons for that.

As president, he hasn't yet come up with a detailed tax reform plan.

As a 2016 candidate, he did. But those details don't match today's description, and they represent the opposite of what Trump's core supporters, as well as most Americans, say they want.

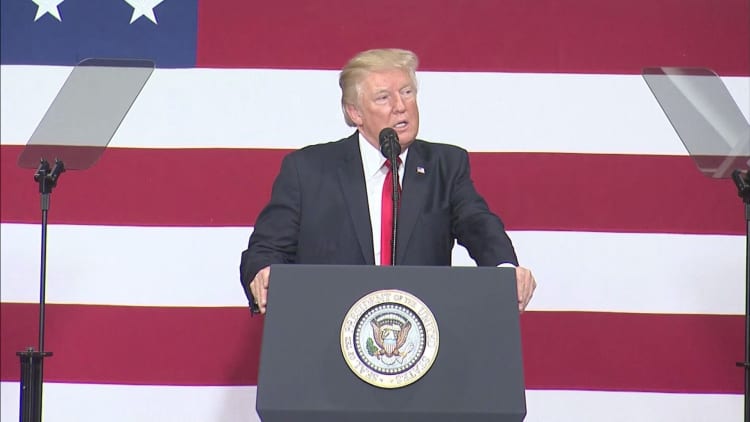

In remarks in Springfield, Mo., the president called for tax reform in the name of "loyal, hard-working Americans and their families," "middle-class families,' "the forgotten people," and U.S. companies struggling under tax burdens much higher than those in other countries.

The result, he said, would be "a big, fat, beautiful paycheck" and restored pride for American workers – at the expense of "deep-pocketed special interests" and wealthy people like himself.

The tax reform plan candidate Trump proposed indeed would increase take-home pay for workers in the center of the income scale. Depending on assumptions about economic growth and final legislative language, the conservative Tax Foundation estimated that the middle 20% of earners would see after-tax income rise by anywhere from 1.3% to 9%.

But that plan, which would have cut the top personal rate and eliminated both the alternative minimum and estate taxes, gave the wealthy much greater benefits. The Tax Foundation said the top 1% of earners – such as Trump - would gain anywhere from 10.2% to 19.9%.

The reason Trump skipped over those details, while suggesting his plan would accomplish something very different, is that Americans tell pollsters they want something very different.

In a Gallup poll from April, six in 10 Americans overall said upper-income earners pay too little in taxes. They've said the same thing in Gallup surveys going back a quarter-century as income inequality has widened in the U.S. economy.

The blue-collar white voters in Trump's base feel the same way – even more strongly. In a post-election survey by the Democracy Fund Voter Study Group, 75% of Trump's strongest bloc of supporters called for higher taxes on those earning more than $200,000 per year.

In his Springfield speech, Trump also vowed to boost the American economy by freeing Americans companies of what he called an oppressive tax burden. Combining the top federal corporate rate of 35 percent with state and local taxes, the president said, the U.S. has fallen behind France, Germany, Canada, Ireland, Japan, Mexico and South Korea, among others.

"We have totally surrendered our competitive edge," he said.

There are two political problems with that call for lower corporate taxes.

First, Trump lately has been touting the robust health of American business. "Corporations have NEVER made as much money as they are making now," the president tweeted on August 1.

Second, most Americans want corporations taxed more, not less. In that April Gallup survey, 67 percent of Americans said corporations pay "too little" in taxes, while just 9 percent said "too much."

That doesn't make lower taxes on the wealthy and business unwise policy for Americans overall. Democrats say economic gains under Presidents Clinton and Obama show that top-end tax increases don't harm growth; Republicans insist growth would have been higher without them.

But they underscore why the White House and Congress have fallen far behind their initial schedule for tax reform, under which a Republican plan would have already been passed into law. Their plans smack headlong into public opinion, just as their failed attempt to repeal and replace Obamacare did.

House Republicans, just like candidate Trump, last year proposed a plan that would have delivered much larger gains to the wealthy than to the middle class. Now the White House and Congress are struggling to develop a unified approach – on tax rates, tax benefits and federal deficits – that can withstand the political heat that comes with actual votes on Capitol Hill.

That could include heat from Trump's own hard-care base, to which he has clung ever more tightly as his overall popularity has fallen. The president's tax team, as well as the gap between rhetoric and policy reality, encapsulates the challenge.

In the Democracy Fund post-election survey, 63 percent of the president's strongest bloc of supporters expressed hostility to Wall Street. Trump's point men on tax reform: Treasury Secretary Steven Mnuchin and National Economic Council director Gary Cohn – both veterans of Goldman Sachs.