Barnes & Noble shares jumped as much as 16 percent Thursday afternoon after The Wall Street Journal reported an activist investor has proposed a deal to take the bookseller private. The stock was halted briefly on the news, and again while awaiting Barnes & Noble's response.

Sandell Asset Management came to the retailer with a transaction that would value Barnes & Noble at around $650 million, or $9 a share. Barnes & Noble shares closed Wednesday at $6.60 apiece.

Barnes & Noble issued a rebuttal, saying: "The Company does not take Sandell's proposal as bona fide in that Sandell is the beneficial owner of 1 million common Barnes & Noble shares worth approximately $7 million."

Sandell controls roughly 2 million Barnes & Noble shares, for a stake in the company of about 2.75 percent, a securities filing shows.

A representative from the asset management firm didn't immediately respond to CNBC's request for comment.

Even with Thursday's gains, shares of Barnes & Noble have tumbled more than 30 percent in 2017.

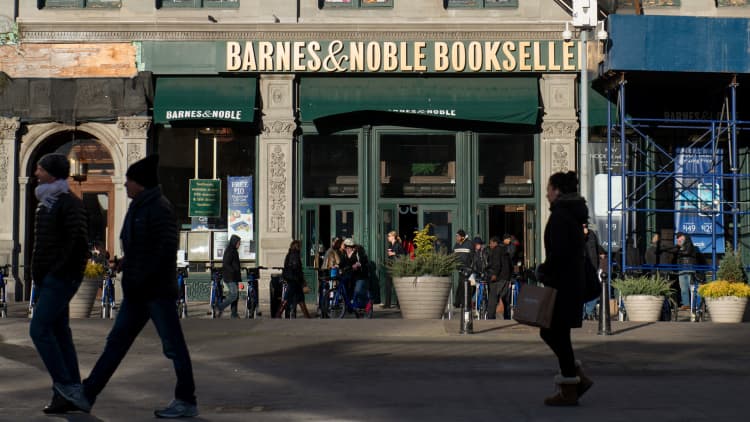

The bookseller faces heightened competition from the likes of Amazon Books and other retailers moving their book assortments online. Heading into the key holiday season, Barnes & Noble aims to grow its same-store sales, something the company wasn't able to do a year ago.

One person standing in Sandell's way is Barnes & Noble Chairman Leonard Riggio.

Riggio doesn't agree with the structure of the proposed deal, which calls for $500 million in debt financing and $250 million from current Barnes & Noble shareholders. The chairman still has a roughly 18 percent stake in Barnes & Noble, after purchasing the company in 1971.

"Riggio has no intention of rolling his shares into such a transaction, and the Company believes a debt financing of $500 million is highly unlikely," Barnes & Noble said.

This isn't the first time Sandell has come after Barnes & Noble.

In July, the asset management firm issued a note calling Barnes & Noble's real-estate assets "beachfront property" with untapped value.

"What makes the under-valuation of Barnes & Noble all the more shocking is that, as opposed to the numerous other national apparel, footwear, grocery, and home furnishing chains abounding in this country, there is but one truly national bookstore chain," Sandell's CEO, Thomas Sandell, said at the time.

Sandell called on Barnes & Noble to retain an investment bank to explore strategic alternatives, which aim at "achieving a privatization."