An arcane provision in the Senate tax bill could end up undermining the benefits of lower rates for businesses and households, according to tax experts.

The Senate's bill maintains the alternative minimum tax, a measure that has been widely criticized as complex and onerous by both sides of the aisle. It was kept in the bill during a dramatic series of last-minute negotiations to provide lawmakers with about $173 billion in revenue over a decade that would help offset costly deals. This helped to persuade reluctant Republicans to support the bill. But it also opened the door to a host of unintended consequences and a backlash from the business community.

"Retaining the AMT in reform is even more harmful than it is in its present form," Caroline Harris, chief tax counsel at the U.S. Chamber of Commerce, wrote in a blog post. "It eviscerates the impact of certain pro-growth policies."

Currently, the corporate tax rate is 35 percent, and companies are only subject to the AMT if their effective tax rate falls below 20 percent. Government data show it raised about $4 billion in 2013, with most of the tax falling on the finance, mining and manufacturing industries.

But under the Senate tax plan, the corporate rate would be cut to 20 percent — the same rate imposed by the alternative minimum tax. If companies repatriated foreign earnings or used popular credits like the one for research and development, their effective rate would fall below 20 percent — and the AMT would kick in.

That would essentially wipe out the value of those tax breaks and penalize companies for taking advantage of the new system that lawmakers have labored to create.

"It effectively repeals some tax preferences with strong political support," said Lily Batchelder, a professor at New York University.

Households could also see their benefits scaled back. The Senate bill increases the income threshold subject to the AMT from about $50,000 to $70,000 for single filers and $78,000 to $110,000 for joint filers. Joseph Rosenberg, a senior research associate at the Tax Policy Center, said that means fewer people overall will have to pay the alternative tax.

But because of other changes in the tax bill, the alternative tax would now hit almost every married couple with income between $300,000 and $750,000, according to his analysis. He estimated couples would pay about $8,000 more than they would have under the Senate plan, chipping away at the benefits of the bill's lower rates.

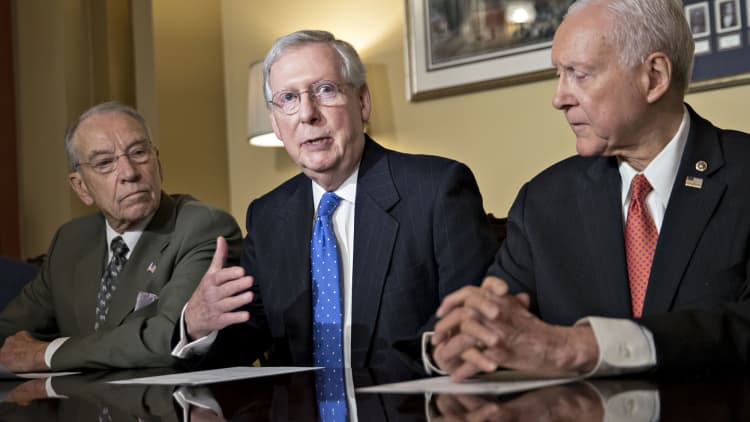

Top Republicans have acknowledged the issues and signaled that they intend to address the topic in a conference committee over the next few weeks before final legislation is released. The House version of the bill repeals the individual and corporate alternative minimum tax. Ways and Means Chairman Kevin Brady, R-Texas, told reporters that Republicans "feel strongly" that it should be permanently eliminated.

"That cost and complexity actually undermines some of the pro-growth provisions that we kept in the tax code," he said.

On Wednesday, Senate Finance Committee Chairman Orrin Hatch, R-Utah, also indicated that lawmakers are hoping to take it out of the final bill.

"Right now it doesn't look like it [is in there]," he said, according to Reuters. "But you never know."

WATCH: 41 GOP representatives want stock sale provision out of tax bill