Sales of newly built homes are falling, and the culprit is clear. Homebuyers increasingly can't afford what they want. Higher mortgage rates, combined with the loss of homeowner tax breaks in some of the nation's most expensive markets, are taking away buying power.

Sales fell in December, when the new tax law was signed, and then again in January, when mortgage rates moved higher. Sales are now at their lowest level since August of last year.

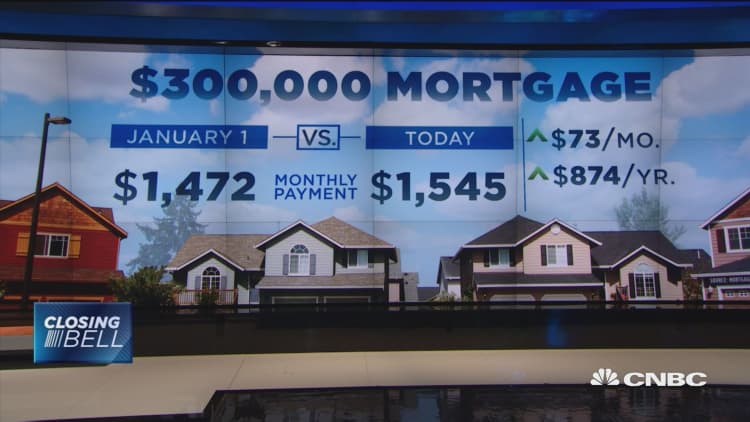

The government's measure of new home sales is based on signed contracts during the month, reflecting the people who are out shopping and signing deals with builders. It is therefore a strong read on current reactions to home affordability. Mortgage rates moved a full quarter of a percentage point higher during January, from below 4 percent to about 4.25 percent. It then took off further from there.

"It seems that the jump in mortgage rates in January had an immediate impact on contract signings," wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group. "You can't get more interest rate sensitive when it comes to homes and cars with the associated cost to finance."

Higher home prices are adding to the difficulty for buyers. The median price of a newly built home rose to $323,000, a 2.5 percent gain compared with January 2017. Builders are not only increasing prices, but they are also mostly focused on the move-up market, not the entry level where homes are needed most.

While there is a severe shortage of existing homes for sale, the opposite appears to be the case in the new home market. Supply rose to the highest level in four years, another sign that new construction is increasingly out of financial reach for today's home buyers.

"The drop in sales may be due to saturation in the upper price range of the market, which should compel builders to follow the market and build more moderately priced homes," wrote Joseph Kirchner, senior economist at Realtor.com. "We may be beginning to see this with the largest drop for new home sales in homes priced above $500,000."

The expectation had been for an increase in new home sales in January, after the sharp drop in December. Some economists argue that when rates begin to rise, there is an initial surge reaction from buyers who want to get in before rates increase even further. That did not happen, likely because affordability stood in the way.

Builders did note a drop in buyer traffic in January, according to a monthly sentiment survey from the National Association of Home Builders. That measure did not improve in February, when rates moved even higher. Builder confidence remains high, but largely due to sales expectations over the next six months, not current sales conditions or buyer traffic.

Builders may be counting on the tight supply in the existing home market to push more business their way. Sales of existing homes fell in January as well, with the blame laid squarely on a severe shortage of homes for sale.

"This report is undoubtedly disappointing. Like 2017, 2018 isn't setting up to be particularly favorable for builders — construction materials and permitting costs are high and rising, labor is tight, and desirable, buildable land is scarce and expensive," wrote Aaron Terrazas, senior economist at Zillow. "It seems clear that we shouldn't expect a big breakthrough in new home sales any time soon, and should instead look for incremental progress at best. At this point, we'll take whatever we can get."

WATCH: Rising interest rates hit borrowers' wallets