President Donald Trump's tweets about Amazon aren't going to make regulatory action against the company more likely, according to antitrust experts. If anything, they'll be counterproductive.

"If you could bet on the agencies taking no action, I'd be standing there with a handful of tickets," said William Kovacic, professor of global competition law and policy at George Washington University and director of Competition Law Center.

"The last thing the Department of Justice and the Federal Trade Commission want is to become puppets of elected officials. They'll run your life every minute."

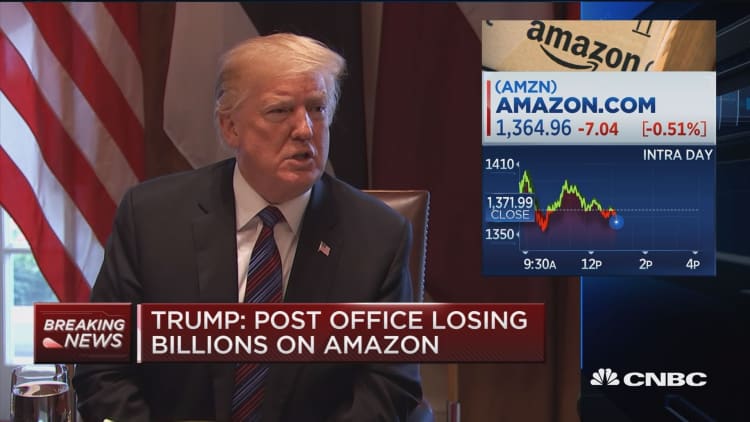

Trump continued his Twitter attack on Amazon on Tuesday, saying the world's fourth-largest company is "costing the United States Post Office massive amounts of money for being their Delivery Boy."

He has called Amazon a "no-tax monopoly" and, according to a Vanity Fair article, is pondering ways to "f--- with" Amazon CEO Jeff Bezos, who also owns The Washington Post.

Presidents and other elected officials have called out companies for hurting consumers for decades. But while political rhetoric can cause companies to proceed with caution on pricing and acquisitions, it won't cause a regulatory agency to move forward with a monopoly or monopsony case, said Keith Hylton, professor of law at Boston University.

"I still believe there's a fair amount of independence both within the DOJ and the FTC from the president," Hylton said. "The norms and procedures with the agencies don't change much across the administrations. There's not a lot of room for Trump to go after individual companies."

Amazon's real antitrust concerns

That's not to say Amazon is free and clear from regulatory scrutiny. The agencies are "absolutely" taking a closer look at the digital economy and market power of Amazon, Facebook, Google and other tech giants, Kovacic said.

Here are some possible avenues regulators could pursue:

Unfair competition. If Amazon is vulnerable to antitrust law, it will be because regulators are changing the way they interpret antitrust law, said Lina Khan, who published "Amazon's Antitrust Paradox" in the Yale Law Journal in January.

Amazon wouldn't be punished for price gouging, since it generally pursues low prices at the expense of profits. Instead, it would be attacked for pushing other competitors out of the market.

"It's definitely true that you don't want antitrust to be used in protectionist ways," Khan said. "But it's also true that you can't have competition without competitors."

Favoring its own products. The Trump administration could enforce antitrust laws by suing Amazon "for using its platform and algorithms in a biased manner that prioritizes Amazon's own products and services over those of merchants that are dependent on Amazon's platform and with whom Amazon competes," according to a December 2016 paper published by The Capitol Forum, a news and analysis service that focuses on how policy affects market competition. (This would be similar to how the European Union went after Google.)

"It only takes one enforcement action covering a narrow instance of Amazon employing such bias to create precedent that could put its business model — leveraging its platform to vertically integrate into a wide range of industries — at risk," according to the analysis.

Acquisitions. Amazon may also take a more cautionary approach toward future acquisitions if it knows it's being watched by both Trump and regulators, Kovacic said. Amazon bought doorbell-maker Ring for about $1 billion in February and acquired Whole Foods for $13.7 billion last year.

Still, the DOJ should operate independently from the president on decisions to block deals. Hylton believes Amazon's Whole Foods acquisition would be approved today, just as it was last year.

Regardless, bringing a "giant monopolization case" against Amazon would be foolish unless the agencies had reams of evidence to back up a case, Kovacic said. That's not going to be affected by Trump one way or another, he said.

"There's no question being in the spotlight makes companies more cautious," Kovacic said. "But bringing a case against Amazon won't be easy. Most antitrust professionals, when pushed to do something that would not be sustainable, say 'check, please' and head for the exit."

Using the Postal Service

In the short term, Trump's best bet to score a "win" against Bezos is through the Postal Service, although it's unclear exactly how much power Trump would have in negotiating new contract details with Amazon, Hylton said.

Amazon's current five-year contract with USPS ends in October.

A Capital Forum paper written March 29 by Teddy Downey said sales officials from USPS may start negotiating a new deal as early as April 15. A Citigroup research report estimates Amazon could have to pay up to 41 percent more for its average package in a new deal. That may be prompting the timing of Trump's Twitter attacks.

"A renegotiated deal with USPS is the issue that is most near-term, expensive and potentially disruptive to Amazon's business model," Downey said.

Advisors are also encouraging Trump to cancel Amazon's pending contract with the Department of Defense to provide cloud computing services through Amazon Web Services, sources told Vanity Fair.

One other avenue Trump may traverse is attacking Amazon for its loose restrictions on Chinese manufacturers, who are easily able to get their products into Amazon's U.S. fulfillment centers and onto Amazon's marketplace platform. Thus far, the president hasn't tweeted about this issue.

— CNBC's Ylan Mui contributed to this report.