Shares of Celgene sank more than 8 percent after hours Wednesday following news that investment firm Wellington Management does not support Bristol-Myers' acquisition of the biotechnology company.

In January, Bristol-Myers Squibb announced its plans to buy cancer drugmaker Celgene in a cash and stock deal valued at $74 billion.

Wellington Management is the largest institutional holder of Bristol's common stock at about 8 percent. Wellington said in a release that it "does not believe that the Celgene transaction is an attractive path towards" business that "secures differentiated science and broadens the future revenue base."

Wellington said the acquisition asks Bristol's shareholders to accept too much risk while there are other paths to create value for shareholders. The investment company also worries the execution of the acquisition will be more difficult than depicted by company management.

Furthermore, Wellington said the terms of the agreement offer "Bristol shares to Celgene shareholders at a price well below implied asset value."

Bristol-Myers said since announcing the Celgene transaction on January 3, its board and management team have had numerous meetings and conversations with shareholders, including Wellington.

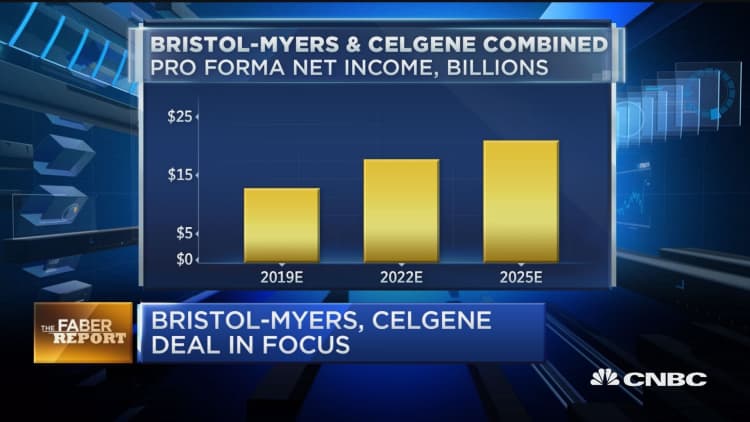

"We believe that we are acquiring Celgene at an attractive price, and that this transaction presents an important and unique opportunity to create sustainable value," Bristol-Myers said in a statement.

Bristol said it looking forward to its stockholder meeting in April to deliver "the enhanced value this combination creates."

The two companies started talking about the deal Sept. 2018, when Bristol approached Celgene.

Celgene has also been working on an experiential gene therapy that is a highly competitive and potentiality profitable area of the biotech industry. Buying Celgene gives Bristol access to cancer drugs, an area Bristol struggles with in comparison to its rival Merck.