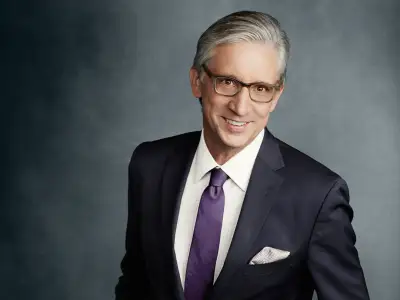

Bob Pisani

CNBC Senior Markets CorrespondentA CNBC reporter since 1990, Bob Pisani has covered Wall Street and the stock market for over 25 years. Pisani covered the real estate market for CNBC from 1990-1995, then moved on to cover corporate management issues before becoming On-Air Stocks Editor in 1997. In addition to covering the global stock market, he also covers initial public offerings (IPOs), exchange-traded funds (ETFs) and financial market structure for CNBC.