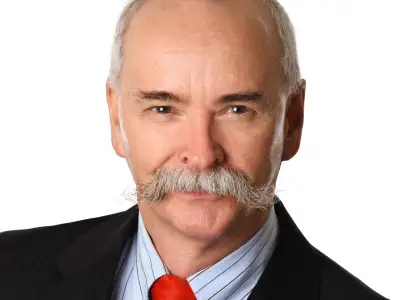

Daryl Guppy

ContributorDaryl Guppy is an independent technical analyst who appears frequently on CNBC Asia. He runs training, analysis and resource workshops for retail and professional financial market traders involved in stocks, CFDs, warrants, derivatives, futures and commodities in China, Malaysia, Singapore and Australia. He has his own trading company, guppytraders.com. He is a special consultant to AxiCorp.