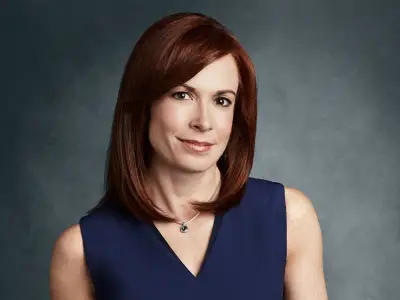

Diana Olick

CNBC Senior Climate and Real Estate CorrespondentDiana Olick is an Emmy Award-winning journalist, currently serving as CNBC's senior climate and real estate correspondent. She also contributes her climate and real estate expertise to NBC News NOW, MSNBC, NBC's "Today" and "NBC Nightly News." She is a regular guest speaker and does guest segments on NPR and C-SPAN. Her work on CNBC.com won the Gracie Award for "Outstanding Blog" in 2015.

Soon after joining CNBC in 2002, Olick recognized the quick run-up in the housing market, fueled by investor flipping, and consequently launched the network's real estate beat. She covers both commercial and residential real estate as well as the mortgage market. Olick was at the forefront of reporting on the housing boom, the subprime mortgage collapse, the resulting housing crash and the ongoing recovery. She also launched the real estate page on CNBC.com and is its primary author.

In 2018, Olick envisioned a new series for the network called "Rising Risks," which examines all aspects of the growing risk to real estate from climate change. The series grew beyond real estate and in 2021, Olick began covering climate full-time across all sectors. That same year, she covered the COP26 United Nations climate summit in Glasgow, Scotland, reporting on government, corporate and private sector investments in the fight against climate change.

In early 2022, Olick launched an additional climate series, Clean Start, which follows venture capital money into climate startups. The series airs weekly and has its own page on CNBC.com/clean-start.

Prior to joining CNBC, Olick spent seven years as a correspondent for CBS News. Olick began her career as a local news reporter at WABI-TV in Bangor, Maine; WZZM-TV in Grand Rapids, Michigan; and KIRO-TV in Seattle. She joined CBS in 1994 as a New York-based correspondent for the "CBS Evening News with Dan Rather" and "The Early Show." She also contributed pieces to "48 Hours" and "Sunday Morning."

At CBS, Olick worked in the New York, Dallas and Washington, D.C. bureaus, covering such stories as the World Trade Center conspiracy trial, the crash of TWA Flight 800, the JonBenet Ramsey murder mystery and was the exclusive correspondent for the trial of Oklahoma City bomber Terry Nichols. She also took a temporary assignment in CBS' Moscow bureau, where she chronicled the brief presidential campaign of Mikhail Gorbachev.

Olick has a B.A. in comparative literature with a minor in soviet studies from Columbia College in New York and a master's degree in journalism from Northwestern's Medill School of Journalism.

Follow Diana Olick on X @DianaOlick on Instagram @DianaOlick and on Linkedin.