With a recent earnings miss and a sharp drop in its share price, technology giant Apple needs to look to emerging countries for growth and shift its focus away from a saturated developed market, analysts told CNBC.

Wednesday saw the biggest one-day fall in Apple's stock since 2008. The stock has already seen a steady decline of around 18 percent since it peaked in September. The company announced quarterly earnings in October that missed forecasts and an outlook that fell short of estimates.

"What people are starting to question now is the growth in the very high-end markets where Apple has absolutely dominated, it's starting to look like it might come to an end," James Gautrey, global equity analyst at Schroders told CNBC Friday.

"The stock has been priced for growth.......we're moving into a different phase now."

(Read More: Apple Becoming Like Microsoft? Fears Grow After Miss )

This week the bad news continued as research firm IDC said Apple's rank in China's smartphone market fell two places to sixth spot as competition from local mobile firms rose. And on Wednesday Nokia stole a march on the firm by announcing a tie-in with China Mobile to release its new Lumia model. Nokia's share price has since surged 9 percent on the Finnish stock market.

Gautrey argued that Apple needed to address this issue and look into markets like China, as well developing new products to ensure a turnaround.

"That's really where the growth opportunity is in smartphones, tablets, it's kind of what will drive the next three to five years," Gautrey said, adding that it's not just high-end that it should be focusing on, and that the real volume is much lower down.

"The problem at the moment is that Apple have nothing for that market. The products, the iPhones are $500-600 products. That's affordable in the developed world, in the emerging world that's not really of interest."

And it's not just Nokia that has seen a resurgence whilst Apple has stalled. Research in Motion and Dell have also seen upticks on the Nasdaq in recent weeks.

"Investors are becoming weary of some of the old stories - the growth that has done incredibly well - then looking now at some of the turnaround plays again," Gautry said.

(Read More: Apple Rebounds After Flirting With Death)

Nancy Curtin, chief investment officer at Close Brothers Asset Management agreed with Gautrey that Apple needed to take measures to find new pockets of growth to drive the company forward.

"I think the real opportunity for Apple is to take its franchise and to move into emerging markets as well as new products," she told CNBC Friday.

"There seems to be a dearth of big new product offerings for next year and maybe that's part of the problem as well."

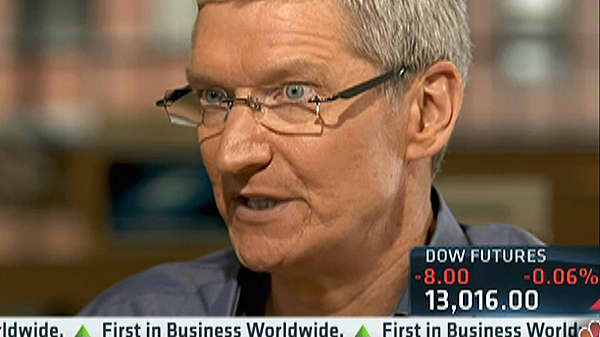

In an exclusive interview with NBC on Thursday, Apple CEO Tim Cook sent the rumor mill into overdrive by hinting that the company may be looking to plunge into TV development.

(Read More: At Least One Mac to Be Made in USA)

Cook commented to Anchor Brian Williams that "it's an area of intense interest", however, analyst Gautrey was cool on the idea even if it managed to spark excitement among consumers.

"The margins you'll earn on the television, they're not going to be anything like the iPhone," he said.