On Wednesday, the Fed announced another round of easing and said it's going to keep interest rates near zero until the nation's unemployment rate drops below 6.5 percent or inflation tops 2.5 percent.

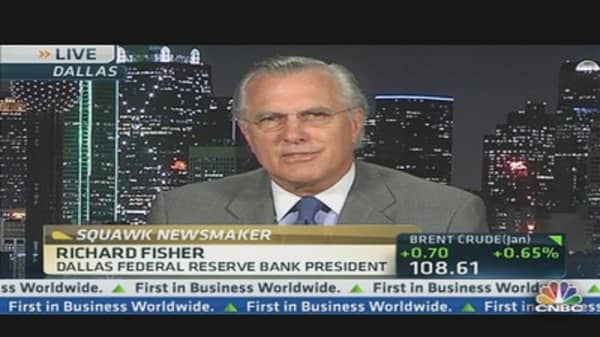

While disagreeing with the adoption of those targets, Fisher said that in the end the Federal Open Market Committee makes its decisions as a whole, unlike Congress on the "fiscal cliff."

"I'm begging members of Congress [and the president] to get something done that reassures consumers and business operators." He added that any fix can't be a temporary solution, because the uncertainty is already affecting consumer behavior. "You cannot count on a central bank to carry an economy."

Fisher would not comment on any contingency plans at the Fed should Republicans and President Barack Obama fail to strike a deal to prevent the automatic tax increases and spending cuts from taking effect in the new year.

"What you see is what you get here," Fisher said. "We have a hyper-accommodative monetary policy here ... cheap and abundant money that the Fed has made widely available."